|

> The Appraiser Coach

> OREP E&O |

Sins of the Past Are Back to Haunt Appraisers

by Richard Hagar, SRA

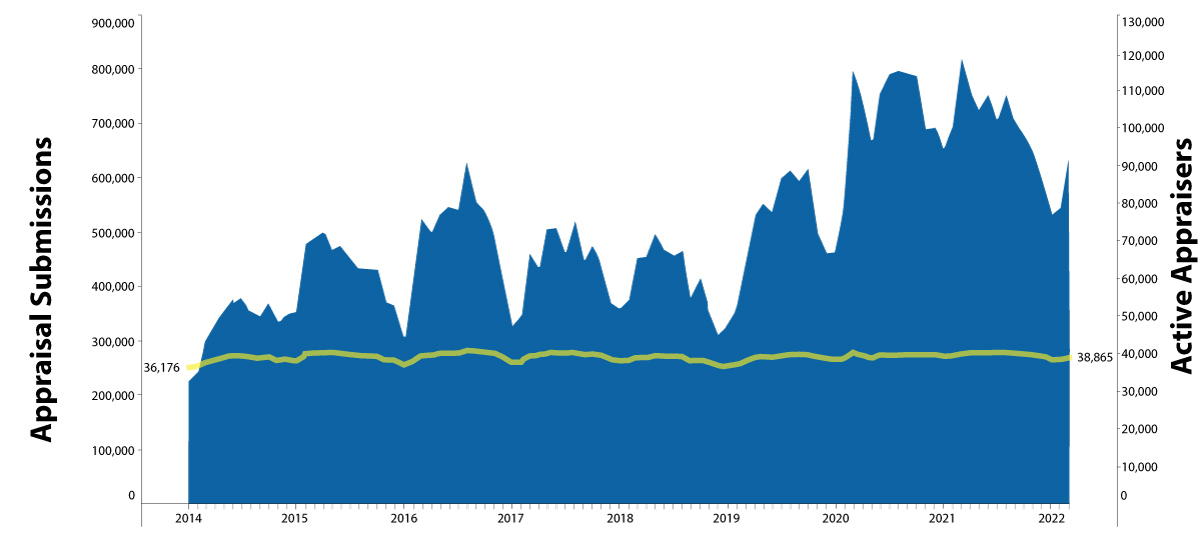

Fannie Mae and Freddie Mac have a list of appraisers that have had their reports submitted to the Collateral Underwriter by various lenders. As you can see by the graph, there are 38,805 names on their list (see the yellow line on Figure 1 below). These appraisers were responsible for creating upwards of 800,000 appraisals per month. There are times where the number of appraisals vastly exceeds the number of appraisers, resulting in long turn-times and the use of appraisal waivers for upwards of 47% of all loans submitted. Since 2018, the demand for appraisers has been massive and lenders flooded appraisers with business, which led to people yelling about an appraiser “shortage”. Once tier 1 appraisers were backlogged 3+ weeks, lenders and AMCs were forced to use their less desirable tier 2 and tier 3 appraisers. In other words, if you had a license and could fog a mirror, you could make money in this business.

Even with the Collateral Underwriter program review, appraisers were overwhelmed. Every lender and AMC were seeking and hiring review appraisers in order to keep up with demand. Due to the shortage of review appraisers (exacerbated by low fees and time pressures) tens of thousands of poorly created appraisals were accepted without receiving adequate review. Unfortunately, because many appraisals were rarely rejected or required corrections, appraisers developed the false notion that poorly crafted appraisals were okay to turn in. Many appraisers were bragging about their ability to fill out two or three appraisal forms a day and receive no call-backs from lenders. However, time and time again we’d review appraisals, that were accepted by lenders, but had failures such as:

• No highest and best use analysis (as if vacant and improved).

• Failure to make appropriate time/market adjustments (positive or negative).

• Using only a single approach to value.

• Incorrect land values.

• Square footage costs and depreciation based more on opinion than reality.

• Unsupported adjustments (adjustments based on “my 30 years in the business” instead of facts).

• Failures to personally inspect and photograph comparables.

• Failure to measure the subject (relying solely on county information).

• Writing in all capitals.

• Inclusion of prohibited words and descriptions.

Figure 1: Appraisal submissions to active appraisers, 2014 to 2022

The list of sloppy appraisal practices is almost endless, and over the past few years were accepted. Why? Because banks, borrowers, and agents were screaming that slow appraisal turn-around times “harmed” their buyers (and the agent’s commission). So, sloppy work was tolerated, but now our world has changed.

One of Many Changes

Federal law states that all appraisals must be reviewed and to that point, Fannie Mae recently sent out a notice “reminding” lenders of their requirement to perform post-closing appraisal reviews. Personally, I believe they should have reviewed appraisals prior to funding the loan but…clearly, I’m not in charge here. Their “reminder” included a nine-page worksheet that provided questions and directives such as:

• Confirm that the appraiser received the full contract with all counter offers.

• Is the original contract date prior to the appraisal’s effective date?

• Were concessions listed and their potential impact on value considered?

• Confirm that nonconforming and illegal land uses were specifically addressed, and the report included information regarding the impact on market value.

• Is the subject’s land better suited for commercial or residential use?

• Were the most appropriate quality and condition ratings provided?

• Look at the photographs. Confirm that the quality ratings of the comparables meet the rating definitions.

• Were all apparent safety and soundness or structural issues noted?

• Confirm that the property is free of structural issues that could impact [loan] eligibility.

• Did the appraiser provide (more than simple comments but) actual support for how the adjustments were derived?

• Compare the appraisal adjustments vs. the model adjustments provided by the CU; are there concerns?

• Do the adjusted and unadjusted prices of the comparables support the final value?

• Does the sketch meet ANSI requirements?

• Were all CU warning messages addressed by the lender?

• How were the messages/warnings resolved and explained?

• Do aerial images confirm that all external influences (external obsolescence) were identified and addressed by the appraiser?

• Check to determine that the appraiser is not on Fannie Mae’s AQM list.

And a final instruction: If the reviewer identifies material errors in the appraisal report that invalidates the appraiser’s opinion of market value…the lender must self-report to Fannie Mae.

Now under Federal law, if a lender, Fannie Mae, or any other person becomes aware of USPAP violations likely to have an impact on the value conclusion, then the appraiser must be reported to appropriate state licensing agencies.

The above is a partial sample of FNMA’s concerns that they would like lenders to recheck in a post-closing review. In other words, they are getting out the microscope and looking deep at our work. So, what are they going to do if Fannie Mae or the lender spots a problem? Well, they are going to turn the appraiser into the state as a way of protecting themselves if the loan goes sideways. This way lenders can shift blame forcing the appraiser to pay for the lender’s losses. So, imagine an arrow that’s been fired at the lender, who ducks and lets it strike the appraiser who was looking the other direction. I’ve been warning appraisers for a long time that this was coming. How does that fast production of sloppy appraisals feel now?

To quote from a Jeremy Bagott press release, “A regulator in Ohio told one appraiser that the Ohio state board was receiving about 40 new complaints monthly from the mortgage giant, each one requiring a separate investigation that can last up to one year.”

Saddle up pilgrim, they’re coming for us.

FNMA indicates that their 2022 lending volume is down 47% from 2021 and is expected to drop by another 50% in 2023. So, it’s pretty safe to state that the “appraiser shortage” of yesteryear is over and reviewers now have more time on their hands. Which appraisers are going to survive when the loan volume is down 75-85% and the poor appraisals of the past are catching up with the appraiser today? Well, for the most part, it’s based on the quality of the appraisals delivered to lenders over the past five years. Do you believe that the quality of your work ranks you as a tier 1 appraiser or do you have a little concern about your rating? Tier 1 appraisers have little to fear but tier 2 and 3 appraisers…

Solutions Today, you likely have more time on your hands, so slow down and take more time improving the quality of your work. Superior quality appraisals can set you free. Stop using MLS photographs, drive-by and take original photographs of the comparables (because that’s what you’ve attested to in your limiting conditions anyway). Learn how to accurately determine adjustments. Follow the ANSI standard when measuring the subject (even if you disagree with the method—it’s the requirement). Take more classes! Don’t stop taking classes just because you have enough CE credit to meet your next renewal; that mentality is for the bottom tier of appraisers.

I typically obtain double the CE credit hours necessary to renew my certificate…double! Why? Because I want to do things better, obtain higher fees, and survive the purge that is coming. Lenders have more choices, and you need a way to stand out from the bottom tier and low fee appraisers. Hop over to my website and take a look at my resume, note all of the classes I take. This is the sort of thing that good lenders are looking for. Low quality lenders only want low fee appraisers—that is not who I want to work for. Besides, with a 75% downturn in the lending business, many of the low-quality lenders and AMCs will also be out of business in the next six months. You need to get noticed by the surviving lenders and AMCs that want the higher tier appraisers.

I strongly recommend that you take my class provided by OREP: Identifying and Correcting Appraisal Failures. The class points out the most common failures flagged by the Collateral Underwriter and then demonstrate how to make simple corrections that will help increase the quality of your work to Tier 1 status. If you don’t need the CE credit, then take the webinar version Identifying & Correcting Persistent Appraisal Failures. I created numerous additional webinars all designed to help appraisers create superior appraisals and get paid more. Click here to access them all.

If you get called on the carpet by a state, a great defense is to tell them that you are improving your knowledge, you are trying to become a better appraiser, and as a result you are better than you were in the past. Based on my experience in helping defend appraisers, this alone can go a long way in convincing a state that you are worthy of retaining your license. Education is a great way to outrun the sins of the past and when the appraisal business flows back, which it will, you’ll be able to leverage it into higher fees.

I’m trying to keep you safe out there.

About the Author

Richard Hagar, SRA, is an educator, author and owner of a busy appraisal office in the state of Washington. Hagar now offers his legendary adjustments course for CE credit in over 45 states through OREPEducation.org. The 7-hour online CE course “How to Support and Prove Your Adjustments” shows appraisers proven methods for supporting adjustments. Learn how to improve the quality of your reports and defend your adjustments! OREP members save on this approved coursework. Sign up today at OREPEducation.org

OREP Insurance Services, LLC. Calif. License #0K99465

by James Scholl

In the past I think Mr Hagar has said he has used ANSI for many years. I wrote to ask him where he gets the second floor ceiling height for the comparable sales? Never heard back. ANSI methods cannot be used to adjust comps if you don’t know the comparable sales second floor ceiling heights! In my area neither assessors nor real estate agents have this information.

-by Jessica Jenkins-Tome'

Writing in all capitals. This while annoying and hard on the eyes, should be the least of our concerns in this profession. If everyone who complained about “reports in all caps” would stop and focus on the rest of the list as much as the complain about FONT, we would be better off…

-by JD

ARTICLE States: “Now under Federal law, if a lender, Fannie Mae, “”or any other person”” becomes aware of USPAP violations likely to have an impact on the value conclusion, then the appraiser MUST BE reported to appropriate state licensing agencies. Question: WHO is “Any Other Person”?? A Borrower? HOW will they know USPAP or applicable violations?

-by jack@towersapp.com

Great article and research on Mr Hagar’s behalf and very timely. Richard refers to tiers are they FNMA’s tiers and can an appraiser learn what tier they might be on?

-