|

“One of the best courses that I have had in 17 years!” -Amy H

>> OREP E&O |

Editor’s Note: Share your experience with trainees in Working RE’s Survey for Trainee Supervisors and help the entire industry. Take the four-minute survey now.

GSE Buybacks and Remediation Letters

by Isaac Peck, Editor

As most appraisers know, Fannie Mae (Fannie) and Freddie Mac (Freddie) implemented “temporary appraisal flexibilities” during the pandemic to accept desktop and exterior-only inspection appraisals in lieu of the traditional interior-inspection appraisal.

Fannie said that appraisers using these flexibilities “may have to rely on information from an interested party to the transaction (borrower, real estate agent, property contact, etc.) and additional verification may not be possible.”

However, Fannie was careful to note that appraisers should be collecting this information from all available sources, including interviews with homeowners, real estate agents, etc. And that while appraisers can make an assumption that those sources are correct, appraisers cannot make an assumption as to the condition of the property without having data (interviews, pictures, etc.) that supports that conclusion.

Fannie Mae specifically forbade the use of an Extraordinary Assumption, writing that “Appraisers must have data sources they consider reliable,” and that “if adequate information about the subject property is not available from a credible source, then the desktop or exterior-only inspection appraisal is not acceptable.”

Fannie Mae was careful to also add: “The assumption that data sources are correct is not considered an Extraordinary Assumption.” In other words, appraisers could make an assumption that the data analyzed is correct (including interviews with homeowners/agents, etc.), but the appraiser cannot make an Extraordinary Assumption about the condition of the interior of the property if they had no data to support that conclusion.

A number of appraisers were and are still confused about this process. Across numerous appraiser forums, including appraiser-focused Facebook groups, discussions indicate that many appraisers believed that it was perfectly okay to use Extraordinary Assumptions. “I do it all the time and I don’t see a problem. I make an Extraordinary Assumption that the home is similar on the inside as it looks on the outside,” wrote one appraiser on Facebook. “In my opinion, you can’t do an exterior-only without an Extraordinary Assumption,” wrote another appraiser.

The final extension of these flexibilities was discontinued on May 31, 2021. Today, a reckoning about the misuse of the flexibilities is beginning to become evident.

(story continues below)

(story continues)

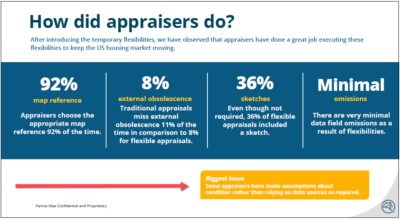

Remediation Letters

Fannie Mae personnel have used the following slide, in their presentations at various industry conferences, to show the biggest appraisal issues: making assumptions about the condition of the property rather than relying on data sources as required (see Figure 1 below). The result of this is that lenders and appraisers now are receiving remediation letters from the GSEs. Some AMC and lender sources report to Working RE that up to 30 to 40 percent of all appraisals were completed incorrectly during the pandemic, with many appraisers employing an Extraordinary Assumption around the relevant property characteristics and the quality and condition of the property.

The remediation letters focus on two separate issues:

1. Appraisers used an Extraordinary Assumption about the property’s condition (not allowed), or

2. Appraisers did not state how they determined this information at all.

Figure 1: Slide from Fannie Mae on Temporary Appraisal Flexibilities

(click to see larger image)

In response, many appraisers are complaining that the GSEs, lenders, or AMCs are asking them to violate the Uniform Standards of Professional Appraisal Practice (USPAP) by not allowing an Extraordinary Assumption. The conflict arises because Fannie Mae’s guidelines state: “If adequate information is not available to complete the appraisal, the assignment cannot be completed.”

While there is a conflict between USPAP and Fannie Mae in the minds of many appraisers, Fannie makes its own rules and was upfront from the beginning that if the appraiser could not find data (including interviews) on which to produce a credible report, they should decline the assignment instead of making an Extraordinary Assumption (which was not permitted).

Refinances that were ordered as exterior-only are the primary loan type where this is a potential problem, according to John Dingeman, Chief Appraiser at Class Valuation. This is because there is often no prior MLS listing data for the appraiser to rely on, Dingeman said. “The appraiser often didn’t call the homeowner because they thought they couldn’t contact the homeowner,” says Dingeman.

Fixing It

Dingeman says that the remediation letters being sent are, in many cases, requesting a retrospective appraisal on the same property. “The GSEs are giving appraisers the opportunity to resolve the issue,” says Dingeman.

If an appraiser did not collect any data and just made an Extraordinary Assumption about the interior condition of the property, Dingeman says that appraisers who receive a remediation letter may need to reach out to the borrower and collect that data now, in order to meet Fannie requirements.

“Appraisers who receive remediation letters can call the borrower and ask them questions about the home. As the appraiser, you can explain to the new homeowner that the banks offered an appraisal flexibility to appraise the home from the exterior during the pandemic, but they’re doing some audits now and you are calling to confirm some information. Oftentimes, the homeowner can tell the appraiser about the property and even send interior pictures, which the appraiser can use to respond to the remediation letter,” says Dingeman.

The risk of not complying is that a remediation letter may turn into a repurchase demand. “The GSEs have issued remediation letters to the lenders, which will turn into a repurchase demand if not fixed,” said Dingeman. “Appraisers need data that allows them to credibly identify the relevant property characteristics and opine on the quality and condition without the use of an Extraordinary Assumption.”

Fannie Mae and Freddie Mac began issuing remediation letters in early 2021 and those letters are likely to continue in the months to come. Stay safe out there!

About the Author

Isaac Peck is the Editor of Working RE magazine and the President of OREP, a leading provider of E&O insurance for real estate professionals. OREP serves over 10,000 appraisers with comprehensive E&O coverage, competitive rates, and 14 hours of free CE for OREP Members (CE not approved in IL, MN, GA). Visit OREP.org to learn more. Reach Isaac at isaac@orep.org or (888) 347-5273. CA License #4116465.

Tips for Smoother Appraising

CE Online – 7 Hours (45 states)

How to Support and Prove Your Adjustments

Presented by: Richard Hagar, SRA

Must-know business practices for all appraisers working today. Ensure proper support for your adjustments. Making defensible adjustments is the first step in becoming a “Tier One” appraiser, who earns more, enjoys the best assignments and suffers fewer snags and callbacks. Up your game, avoid time-consuming callbacks and earn approved CE today!

Sign Up Now! $119 (7 Hrs)

OREP Insured’s Price: $99

>Opt-In to Working RE Newsletters

>Shop Appraiser Insurance

>Shop Real Estate Agent

Insurance

Send your story submission/idea to the Editor:

isaac@orep.org

by Mary T Thompson

Where were the underwriters in this process.? If this was not allowed per Fannie Guidelines, then the appraisals should have been rejected in the review/underwriting process! I guess they just wanted to close loans. Not surprising!

-by THOMAS TIPTON

Correct!!! They could care less about an appraiser than one can imagine, but they are interested in being paid. Appraisers pay for E&O insurance, and that is where the money will likely come from if they ‘prove’ the appraiser produced a misleading Report. As an added bonus the appraiser will most likely need to answer to their state’s appraisal board, and then the appraiser really does have something to worry about.

-by Ed Bedinotti

USPAP defines an extraordinary assumption and a hypothetical condition. It does not define an assumption. Furthermore, just as a lender/client – or the GSE’s for that matter – just as they cannot dictate what types of sales an appraiser can use (arm’s length, non-arm’s length), they cannot dictate that an appraiser ignore/not utilize a USPAP defined term/condition (an extraordinary assumption). The appraiser must remain impartial and independent. The GSE’s carefully worded their requirements, but a licensed/certified appraiser has to remain impartial and independent so the appraiser would have to follow USPAP, regardless of Fannie Mae’s requirement. The GSE’s tried a similar tactic when the current Fannie Mae Forms came out in regards to who could rely on the report. Regardless of the GSE’s guidelines, appraisers had to adhere to USPAP and write who the intended user of the report was and what the intended use was. Fannie ended up having to make a stipulation that appraisers could add commentary in regards to certification #23.

-