|

> Trainee Workshop

> OREP E&O |

Editor’s Note: Share your experience with trainees in Working RE’s Survey for Trainee Supervisors and help the entire industry. Take the four-minute survey now.

Grappling with Desktop Appraisals

by Isaac Peck, Editor

March 19th, 2022 marked the official date that Fannie Mae started accepting desktop appraisals—a date that will perhaps signify a monumental shift in the appraisal industry as we look back at the industry one day.

Just how many mortgages will these changes affect?

Fannie Mae’s criteria is fairly straightforward. All mortgages which meet the following criteria will qualify for desktop appraisals:

- Purchase transaction

- Single family; one unit

- Primary residence

- LTV of 90% or less

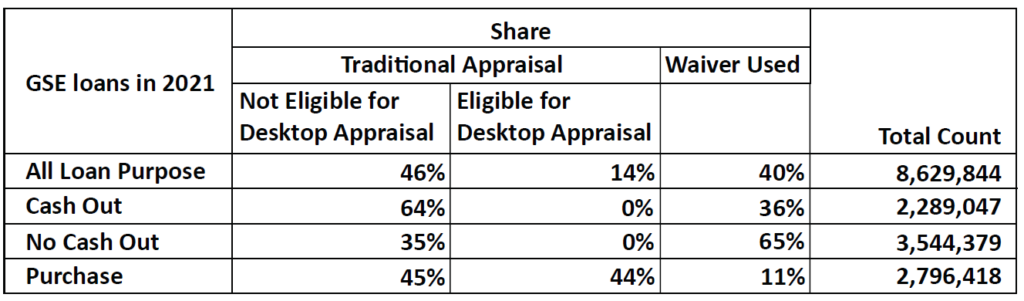

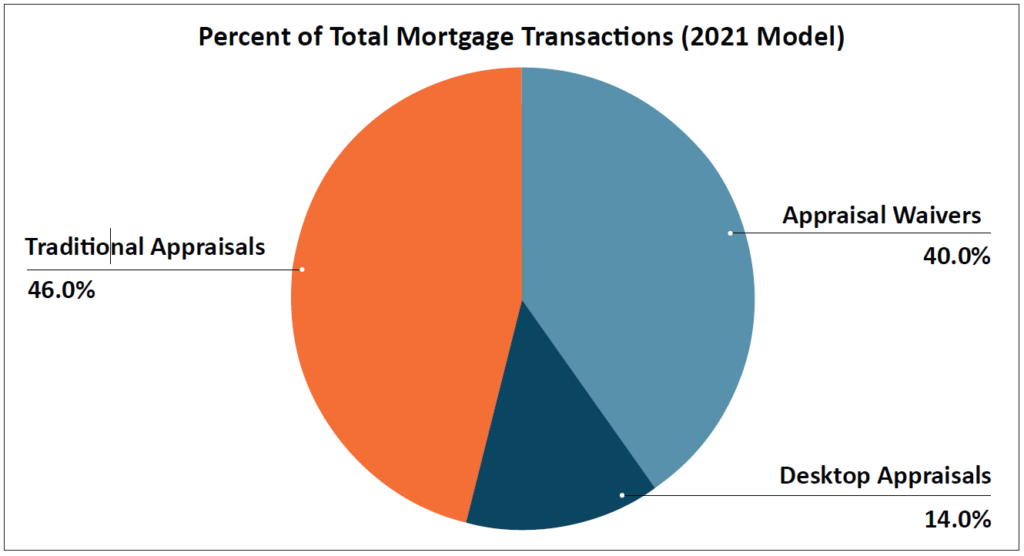

According to data provided by the American Enterprise Institute (AEI), when analyzing 2021 loan numbers for both Fannie Mae and Freddie Mac (GSEs), purchase mortgage transactions made up roughly 34 percent of all mortgage transactions in 2021 (See Figure 1, page 8 for full details). Of those transactions, roughly 11% of purchases had an appraisal waiver used, and an additional 44% of those purchase transactions would be eligible for a desktop appraisal. Projecting the new desktop requirements onto 2021 GSE mortgage numbers, the result is that 40 percent of 2021 loans used an appraisal waiver, and an additional 14 percent of 2021 mortgage activity would have qualified for a desktop appraisal (See Figure 2, page 8). This leaves traditional 1004 appraisals making up only 46 percent of all real estate valuations procured by the GSEs.

Of course, how the ultimate percentages and product mix ends up from year to year will depend on a variety of factors, including purchase versus refinance activity (driven by interest rates), the volume of cash-out refinances, appraisers’ willingness to perform desktop assignments, lender preference with respect to valuation products, data availability to perform desktop appraisals, and the list goes on.

Setting aside the multitude of factors that will influence valuation product mix going forward, it is clear that a sea-change has occurred in the appraisal industry when compared to just a mere three years ago.

In 2019, over 90 percent of GSE valuations were traditional appraisals. Going forward, it is highly likely that less than 50 percent of all valuations procured by the GSEs will be traditional, full appraisal assignments.

Appraisal waivers have taken a significant market share of cookie-cutter, no-cash-out refinance activity, and desktop assignments will further erode the traditional appraisal model.

So what does all this mean for the appraiser going forward?

Redefining the Appraiser’s Role

This official GSE acceptance of desktop appraisals represents a clear move to shift the appraiser further into an analyst role, instead of the traditional “in-the-field” market resource that old-school appraisers have long identified with.

Most appraisers are currently one-person shops and do everything themselves: administration, scheduling, driving to and from the property, inspecting and measuring the property, taking pictures, data entry, data analysis, developing an opinion of value, proofing, billing, and more.

Proponents of desktop and hybrid appraisals see a future where appraisers are more specialized and spend the majority of their time performing “valuation specialist” tasks, instead of spending part of their day as a driver, part of their day as a scheduler, part of their day as a property inspector, and part of their day as a data and valuation analyst/specialist.

Figure 1: Analyzing GSE Loans in 2021 (Data provided by AEI)

Figure 2: Valuations as Percent of Total GSE Mortgage Transactions (Assumes 2021 Numbers)

What Appraisers Are Saying

So far, appraisers have had a mixed response. Nearly 2,000 appraisers responded to Working RE’s Desktop and Hybrid Appraisal Survey, with the results showing a whopping 54 percent of appraisers saying “No,” they will not be performing desktop appraisals, 30 percent of appraisers saying that they aren’t sure, as they need more information, and only 16 percent of appraisers indicating that they are willing to do these types of assignments.

The survey also asks appraisers the same question about hybrid appraisals, with nearly identical results—except that more appraisers answered “No” and slightly fewer appraisers indicated a willingness to perform the assignments.

For those appraisers who say they will refuse to perform desktops, they cite as their primary concerns:

- Liability concerns related to incomplete or inaccurate data from other parties

- Don’t want the headache of dealing with buyers, sellers, and Realtors to collect my data

- Absence of field work will compromise my geographic competency

- Believe it’s bad for the profession

- Inadequate fees

Appraisers may simply need more time to evaluate desktop appraisals. While only 16% of appraisers are willing to do desktops now, 30% of appraisers are still undecided. Given the uncertainty currently surrounding desktops, it’s fair to predict that appraisers may warm up to desktop appraisals and that their adoption by appraisers and lenders may take months, and likely years, before they are fully integrated into the mortgage market. Working RE’s Desktop and Hybrid Appraisal Survey Results are available here.

Desktops an Opportunity?

Mark Walser, President of Incenter Appraisal Management (IAM), believes that this is a turning point for the appraisal profession. “The authorization of desktops signals a clear movement to more technology-based valuation solutions and makes it likely that an expanding number of loan types may, in the coming years, be eligible for these types of valuations,” says Walser.

“The record-breaking mortgage volume has led to extended appraisal turn-times in areas across the country. This is an amazing opportunity for appraisers to step into the gap to provide faster valuations—while freeing up capacity to have appraisers be involved in having more of the valuation pie. Instead of physically driving to the property, appraisers can cut down on windshield time and help lenders and consumers get appraisals faster. It’s a chance to adopt new technology and be part of moving the industry forward,” opines Walser.

(story continues below)

(story continues)

Floor Plans and Methods

One of the things that makes the GSEs’ conception of the new modern desktop appraisal different from old-school “desktops,” is that the GSEs are requiring appraisers to include a floor plan with interior wall partitions in their report. It is worth exploring this distinction further.

The GSEs have explained that the reason they’re requiring floor plans is because of the need to assess the functional utility of a home, and that the “flow” of a home has a notable impact on its value.

But just how are appraisers supposed to get a floor plan?

Walser believes that the original intent of the GSEs was NOT for the appraiser to bear the burden of creating the floor plan. “Ideally, real estate firms should be having the home measured professionally and including that information with the right kind of floor plan on the MLS. Then the appraiser simply needs to verify the floor plan provided, just as they might verify any other data, using virtual inspection technology or other 3rd party data. Even before the GSEs greenlit desktops we were seeing larger real estate firms providing floor plans as part of their listing package. With desktops being accepted by the GSEs, it’s reasonable to expect that practice to increase and it is definitely the ideal way for the mortgage company to get the floor plan to the appraiser upfront,” says Walser.

When it comes to appraisers relying on data they retrieve from the MLS, Fannie Mae has indicated the appraiser has broad discretion in how they verify the information. Walser reports, that for now at least, appraisers prefer to see the property via a virtual inspection. “The majority of appraisers we’ve spoken to say they’d prefer to do a virtual inspection instead of looking at MLS pictures or public records. A virtual inspection is a direct way for appraisers to verify the property is still standing on the effective date, that the layout looks like the floor plan that was provided, talk to the homeowner, ask questions, and so on. It provides appraisers a direct way to verify the data without a 3rd party data collector, and it’s what most appraisers are comfortable with at the present time,” says Walser.

Virtual Inspections

IAM has developed a proprietary app called RemoteVal that allows appraisers to work with a homeowner or real estate agent to virtually inspect the home. RemoteVal allows an appraiser to view the home in real-time and perform a virtual walk-through while instructing the person holding the phone in the home. Appraisers can capture and upload time-stamped and geographically verified photos, videos and closeups, and can verify measurements of walls. RemoteVal can be used for full floor plan generation, if the appraiser was not provided a floor plan from the get-go. Or it can be used for simple floor plan verification—the appraiser can do a quick walk-through inspection to verify the data in a floor plan that was provided.

Prior to the GSEs allowing desktops starting in March 2022, IAM had been using its RemoteVal tools to provide desktop appraisals to private lenders for the last year. Based on IAM’s experience with RemoteVal, Walser says the average RemoteVal inspection is between 20–25 minutes long for a full inspection where a floor plan is generated, but can be much shorter if the appraiser is simply verifying the data. It is also very simple for a person walking through the property to use the 3D scanning to create a floor plan.

Ultimately, Walser says that virtual inspection technology gives appraisers increased flexibilities and advantages in their businesses. “Think of the ways this might help with rural properties or underserved neighborhoods. Instead of spending one or two hours driving each way in a rural area, an appraiser can do a virtual appraisal inspection and cut three or four hours off the assignment. The consumer in rural areas is typically paying $900 or even over $1,000 for the appraisal, even though the average home value is only $300,000. The same kind of discrepancy can apply to underserved neighborhoods with few appraisers nearby, including those largely populated by minority groups. This can lead to another inadvertent form of bias, as these fees are passed along to prospective buyers. Whereas in an affluent suburban area, the home values could be double but the appraisal fees might only be $500 or $600,” reports Walser.

Scheduling Virtual Inspections

Scheduling a virtual inspection can be done just like the appraiser schedules a regular inspection. “Just like a traditional appraisal, when the order comes in it will have a primary contact, whether it’s the homeowner or a real estate agent. The appraiser can call up the primary contact, greet them, and then schedule a 30–45 minute block of time and tell them: ‘I’ll call you at this time and/or text you a link and we will start a virtual inspection of the property.’ It usually goes very smoothly—invites are simple for an appraiser to send and once the session starts it’s very similar to being on a FaceTime call with them,” says Walser.

The virtual inspection tools create a careful and considered inspection, according to Walser. The appraiser is able to spend some time with the homeowner and ask plenty of questions. The homeowner might turn lights on and off, turn on the garbage disposal, and the appraiser can observe whether appliances work, ask about the age of various home systems, ask about recent upgrades to the home, when the roof was done, and so on. “Every home is different and appraisers are really good at putting together a list of questions on each home. RemoteVal is great at getting those conversations to happen between appraisers and homeowners and agents,” Walser reports.

The Future

The adoption of desktop appraisals will take time, Walser predicts, as appraisers get comfortable relying on third-party generated floor plans and learn more about virtual inspection technology. “Right now the vast majority of appraisers will likely want to use a remote inspection tool to verify any floor plan they are provided, but that may change over time. More seasoned appraisers out there have told us they would rather see the property via the virtual inspection, too, as they’re mastering the technology. They want to have confidence in what they’re doing. Younger appraisers might be more willing to do these in a more streamlined way, and appreciate being able to complete more appraisal inspections in a given day while being provided with data from third parties. We’re committed to transparency and want to show appraisers ‘how the sausage is made’ so to speak. The appraiser is responsible for adhering to USPAP and they need to make sure the appraisal they produce is credible,” Walser says.

Walser compares the adoption of new technology to when we first started sending emails on our mobile phones. “In the beginning of mobile email, you’d type a message, hit send, and wonder if it was sent. Did the network break? Did the email actually get sent? Now when we press send from our phones we have great confidence in the process, device, software, network and so on. The use of third-party data in appraisals may be similar. Once appraisers understand how the floor plans and measurements are being derived, they will be more comfortable. They could compare the floor plan they received from a third-party and do a quick five minute virtual inspection to verify the floor plan and ask a few questions of the homeowner, and then they’re done with that part of the appraisal,” Walser opines.

Appraisal fees are a huge concern for appraisers, of course. Traditional “desktop” appraisals that have been ordered in the years past have been a mere fraction of traditional appraisal fees, typically half. However, Walser says that IAM is currently paying desktop appraisal fees at the same fee as the traditional 1004, “because it’s an appraisal, and they should be paid the same and if the assignment can’t be completed as a desktop, we don’t have to ask the lender for additional fees, we can just move forward.”

Desktop Equals Hybrid?

Clear Capital, a real estate valuation and technology company which also operates an appraisal management company, is taking a hybrid approach. Kenon Chen, Executive Vice President of Corporate Strategy at Clear Capital, reports that because there isn’t a critical mass yet of real estate agents providing floor plans on the MLS, Clear Capital is currently offering its lender clients a hybrid appraisal model in order to deliver the desktop product.

In other words, Chen says that lenders may be wary to order a desktop if they aren’t sure a floor plan is going to be available to the appraiser, or if the appraiser will have enough data. The solution to this is to send a property data collector to the subject property, according to Chen. “To create certainty for lenders, a bridge has to be created in the short-term, which means having a non-appraiser go out and get the data that is needed, then providing it to the appraiser. That’s why we’ve launched Clear Capital’s Desktop Appraisal and Desktop Data Collection products—we provide certainty to the lender that the appraiser will have a floor plan to complete the desktop appraisal That way when the lender orders the desktop, they’re not waiting and hoping that it will work out. They have certainty,” says Chen.

In other words, in the (many) cases where the MLS doesn’t have a floor plan that the appraiser can use, Clear Capital will send out a real estate professional to collect one. “If a floor plan isn’t included in the MLS, Clear Capital has a network of licensed real estate agents and brokers who can inspect the property using CubiCasa’s mobile scanning technology, which will create a floor plan that includes interior and exterior measurements of the property in about five minutes. The CubiCasa technology will also provide measurements per ANSI standards,” reports Chen.

Clear Capital has worked closely with the GSEs over the last few years testing hybrid appraisals on purchase and refinance transactions. Over that time period, Clear Capital has procured over 200,000 hybrid appraisals for the GSEs. “Our close relationship with the GSEs has helped us build a panel of appraisers that are comfortable doing appraisals from their desks. Specifically, where a non-appraiser is doing the data collection and the appraiser is doing the appraisal at their desk. The hybrids we’ve done are very similar to the desktop product. Additionally, when we include a property data collector in the process, we’re actually giving the appraiser a lot more data than if they are just relying on a floor plan provided on the MLS. We have close to 5,000 appraisers that regularly do desktop appraisals for us as part of the hybrid process and we believe we are uniquely positioned to help lenders who are interested in these products,” says Chen.

In terms of the cost to the consumer, Chen says that it remains to be seen over the long-term where the cost will be, but in the short-term he expects the costs to be similar to a standard appraisal. “Another thing that we’re offering lenders is price certainty around desktop appraisals, even though fee increases are often standard, we’ll be providing price certainty options for our lender clients,” reports Chen.

For those appraisers that are interested in doing desktop appraisals, Chen says Clear Capital welcomes them. “We have really been thoughtful about the types of tools we provide with appraisers—so they can have as much data as possible at their desks. Our staff have been doing hybrid appraisals at scale nationwide for several years so they have a lot of great information to help appraisers transition to these products. Our goal as a company is to provide appraisers with revenue earning opportunities so they can earn just as much or more revenue from a desktop appraisal approach as a traditional approach. We are seeing appraisers quadruple the number of appraisals they are able to do, based on being able to stay at their desk and have more time capacity. We want to see the growth of the appraisal profession and give appraisers additional revenue making opportunities. We understand that the appraiser’s role is changing a bit, but this is not a new concept. Desktops have been around for quite a while,” says Chen.

About the Author

Isaac Peck is the Editor of Working RE magazine and the President of OREP, a leading provider of E&O insurance for real estate professionals. OREP serves over 10,000 appraisers with comprehensive E&O coverage, competitive rates, and 14 hours of CE at no charge for OREP Members (CE not approved in IL, MN, GA). Visit OREP.org to learn more. Reach Isaac at isaac@orep.org or (888) 347-5273. Calif Lic. #4116465.

Tips for Smoother Appraising

CE Online – 7 Hours (45 states)

How to Support and Prove Your Adjustments

Presented by: Richard Hagar, SRA

Must-know business practices for all appraisers working today. Ensure proper support for your adjustments. Making defensible adjustments is the first step in becoming a “Tier One” appraiser, who earns more, enjoys the best assignments and suffers fewer snags and callbacks. Up your game, avoid time-consuming callbacks and earn approved CE today!

Sign Up Now! $119 (7 Hrs)

OREP Members: Save 10%

>Opt-In to Working RE Newsletters

>Shop Appraiser Insurance

>Shop Real Estate Agent

Insurance

Send your story submission/idea to the Editor:

isaac@orep.org

by MX75

I still think most appraisers won’t do them. There will be a small subset that prefer not to inspect the home or the ones that actually can’t measure home (I always enthusiastically accept a previous appraisal of a home I am appraising – in 5 to 10% of those reports, a tax assessors sketch has been used for the sketch – the errors have also been copied). I won’t do them. With FNMA not allowing extraordinary assumptions, that should tell you all you need to know about who will be responsible if there is an issue that causes problems. Everyone is so concerned about the consumer saving money, why on God’s green earth does it cost a minimum of 3.3% to close a loan (and six weeks time which is probably the appraisal backlog ;)). Talk about an area ripe for disruption! Oh wait a minute, that’s the people that want to get rid of the appraiser.

-by Rob

Verifying a floor plan without every being at the house sounds like a future settlement from my insurance company.

While it would certainly be entertaining to direct a real estate agent to crawl around looking under beds and deep into under sink cabinets, I think I’ll still pass on the whole thing.

-by Nathan

To me, it’s all about the liability. Who can we rely on to provide the onsite info that is not biased in some way? The realtor? The homeowner? The lender? As far as fees, you claim desktops are, at least now, similar to full 1004’s. But if we will require someone to provide info that they have not before, like a realtor’s floor plan, or a professional onsite walk through person, I am sure they will not do this for free. Coupling their fee with ours, where is the savings? And what happens when they get backed up? Are we really saving time? This also harkens back to our arguments of why we need comp photos. If we trust the realtor for room counts, photos and list/sale prices for comps, why do we need to drive to the comp sales? If we do a desktop appraisal, we are now trusting the realtor for the comp photos. Why did that change? Call me old, but this is obviously a push to get rid of that pesky appraisal fee altogether. But when it crashes again, just like 2008, and it always does, who ya gonna blame?

-by Mark Walser

Hi Nathan,

Mark from Incenter here.

I appreciate your comment and concerns/questions. I’ll try to answer them from the perspective of our RemoteVal solution and encourage you to write me and dialogue directly about this.

1. We have made a solution for Desktop with Remoteval that allows you to virtually scan the home with the agent or other party holding their phone and walking through it. It’s important to understand that they are not scanning, the App is, and you are watching/talking with them live in real time so you can also perform the verification of the property condition, layout, photos etc. You can also take photos by clicking your mouse as you view the home, supplementing missing photos that might not be in the listing.

2) Because of this virtual inspection capability, there is no “3rd party” between you and the person at the property. You are just performing a live inspection, asking questions and viewing the property. Thus, you get to charge your same normal 1004 fees and just save the driving time.

In the Desktop, you can also use MLS data for comparables so this makes it much more streamlined.

3. Final thought – Lenders have communicated with us that they are fine with paying full fees on Desktops if they can get a consistently faster turntime. We fully recognize that 80+% of an appraisal is your experience and market knowledge producing a value opinion, and that 20% or so is made up of that inspection. Our objective is to get you to drive less while still retaining control of the inspection, and getting paid your full fee. If appraisers embrace this paradigm and work with us and other players to help it accelerate, it will be to everyone’s benefit.

Please feel free to email me directly or connect with me on LinkedIn, would love to engage further and have you try some Remoteval assignments with us and get your feedback!

-by Christopher Carlson

How much data is the appraiser going to need to keep in his or her files in case of any questions from regulatory bodies or interested parties? How much storage will be required? Videos, photos, etc. What if there is a question related to the information supplied and it was not recorded? Where are the liability attorney’s on this? All I see is questions and no real answers other than we want it quicker (or even cheaper). Do you really think this will do that?

-by Mark Walser

I cannot speak for other companies – but will speak for the RemoteVal solution. The storage is provided by us, access to the appraiser is free, and the appraiser will always have the ability to view and access the video interaction between them and the property contact, the scan that created the floorplan, the 3D Imagery that the scan created, and the floor plan itself with measurements that the 3D image produced. This is considered workfile, and is only accessible to the appraiser who did the virtual inspection.

-by Deborah Anderson

I’m sure the homeowner will include a photo of that hole in the sheetrock which they haven’t repaired. Or note the smell from pet urine. Looks like a good time to retire.

-by Joshua Richardson

The article goes a long way to try to encourage the use of the desktop platform, however, my experience so far has been negative. The pay for the desktop has been driven down to $250 for a hybrid where I am provided the sketch and photos by a third party. I take 30 Min to “work with a homeowner” or a scanning device inefficiently which is more time than it takes me to drive to a property, measure the house myself and take my own photos. Considering the reduction in pay of almost $150 I would rather DO the inspecting myself. The BEST part of my job is getting out of an office, driving around and meeting people, measuring the property, and taking comp photos. Sitting behind a desk for 8 – 10 hours a day mindlessly looking at a computer screen is not my idea of a good time and the reason I left the IT industry 22 years ago and got into Appraising. The appraisal report for the Hybrid is still the same, the data collection and analysis is still the same, the only thing desktop appraisals have done is reduce my gross income due to the lower fee and force me to be in my “office cube” 24/7. NOT fun!!! …Unless I can sit on a beach in Cancun doing these reports.

-by Mark Walser

Hi Joshua thanks for that response – appreciate your comment and wanted to reply. I cannot speak for other companies but will comment on RemoteVal Desktop as a solution to the instance you describe. In a RemoteVal, the appraiser drives the inspection virtually, can photograph and measure virtually, and in real-time on the effective date view the property to compare it to what the MLS photos look like. Since the appraiser is doing what to us is a full appraisal, we pay the appraiser the same fee for a 1004 Desktop as they would get on a 1004 URAR. There is also the real possibility that in performing a virtual inspection, you as an appraiser might see something that concerns you or makes you want to change the assignment from a virtual inspection to a physical in person appraisal – and if that happens we want you to be able to do so and pivot, and our position is that you have been paid a full fee so just go inspect as normal and we don’t go back to our lender for an additional fee. If the appraisal works in the remote inspection, then you have made your full fee, and didn’t have to drive out there so your profitability was higher due to lower costs, and you still made your normal fee.

Time will tell if our approach wins out over the discount models other solutions are trying to put out there – but then again I’ve always been fond of saying that appraisers will make that choice. If you like our approach and model, I’d ask you to recommend that to lenders giving you orders, and stand firm on your fees and the control of the process being in the appraiser’s hands. Thanks for reading the article!

-by Doug

Whoever thinks that walking through a house in 20 minutes with an app the homeowner has never used is realistic needs their head examined. It takes me at least 20 minutes to do an inspection of a basic house, and I know what I’m doing. And it is a joke to think realtors are going to measure houses and provide floor plans! They can’t even take the time to look up assessor data and compare it to the house now! And if GSE’s want to save time, then take away the driving the comps in the 1004. That alone will save me significant cost and time in rural areas. But here’s the other problem. The photos in the MLS are often insufficient to use in a report. And finally I don’t want to stay at my desk all day long and crank out reports. I like getting out and actually looking at the properties, the land, the sites, etc And right now there isn’t enough work anyway with mortgages down 75% and sales slowing. And now construction is slowing. So these companies that are supposedly going to make a business inspecting homes will not survive. Maybe in a very very hot market. But certainly not in rural areas. Just not enough volume.

-