|

> The Appraiser Coach

> OREP E&O |

Appraisal Volume, Waivers and Property Data Collections

By Isaac Peck, Publisher

Appraisers don’t need a data scientist to tell them that the appraiser profession is experiencing a record-breaking slowdown. Indeed, we have not seen anything like this in recent history—at least for the last 12 to 15 years.

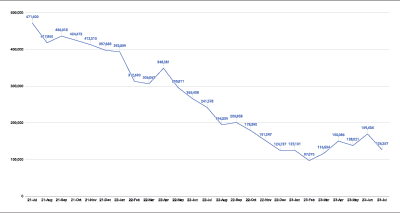

The American Enterprise Institute (AEI) publishes data tracking the mortgage and appraisal production numbers of both Fannie Mae and Freddie Mac (the GSEs) going back to 2013. AEI’s data shows that GSE appraisal volume is at the lowest point since they started tracking it.

For example, in February 2023, total GSE valuations dipped to just 111,000 for the entire month, with appraisal waivers and property data collections making up 14,000 of those “valuations.” This left appraisers with just 97,000 appraisals from the GSEs. According to Freddie Mac’s “Appraiser Capacity” report, just over 30,000 appraisers were active on UCDP in February. The simple math works out to roughly 3.2 appraisals per appraiser—for those appraisers still working for the GSEs.

AEI’s data shows a “peak” of 544,000 actual appraisals completed in November 2020. Compared to February 2023, the decline in appraisal volume is over 82 percent. In other words, the appraisers still standing only have 18 percent of the business that they did during the height of the COVID-19 “boom” times.

Of course, AEI’s data doesn’t capture the entire appraisal landscape. The Department of Veteran Affairs (VA), the Federal Housing Administration (FHA), private lender appraisal work, direct lender appraisals, and commercial appraisals all exist outside the GSE’s domain. Nevertheless, the GSEs handle over 60 percent of all mortgage transactions—meaning that the data is largely representative of the market as a whole.

Here is some data that tells more of the story—at least in terms of what is happening at the GSEs.

(story continues below)

(story continues)

Appraisal Volume

Appraisal volume through the GSEs has been dropping precipitously over the last two years. Appraisers saw unprecedented volume during the COVID-19 boom years of 2020 and 2021. Total mortgage and appraisal volumes began to taper off in 2022 and bottomed out in February 2023. See Figure 1: Appraisal Volume from July 2021-July 2023 to see how the number of appraisals ordered by the GSEs has changed over the last two years.

Since February 2023, appraisal volume appears to have rebounded slightly. Real estate market pundits have predicted that the American public will ultimately adjust to higher interest rates and/or that the Fed may ease rates in the next year or two.

Enlarge image

Figure 1: Appraisal Volume from July 2021-July 2023

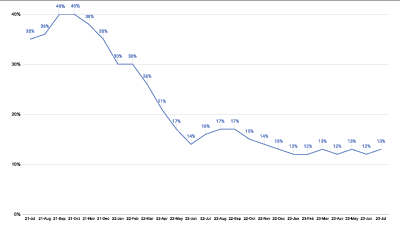

Appraisal Waivers

The use of appraisal waivers by the GSEs reached 49 percent during the height of COVID-19. Thankfully, the use of waivers has dropped dramatically. Over the last six months, appraisal waivers have been hovering around 12 to 13 percent of all GSE mortgage transactions. See Figure 2: Appraisal Waivers from July 2021-July 2023 to see how the use of appraisal waivers has changed on a percentage basis over the last 24 months.

Enlarge image

Figure 2: Appraisal Waivers from July 2021-July 2023

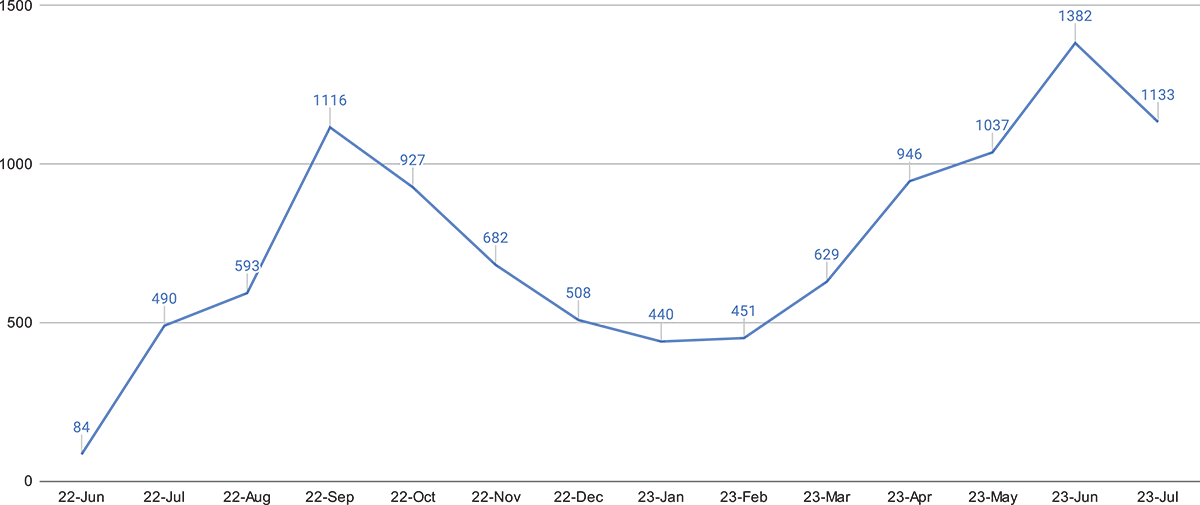

Property Data Collections

Many residential appraisers are very alarmed about the recent promotion of the GSE’s Appraisal Waiver + Property Data Collection (PDC) options, however AEI’s data reveals that the actual number of PDCs being performed is so small as to be nearly insignificant. In fact, in the last 12 months, the number of PDCs ordered by both GSEs combined has averaged less than 1,000 per month. See Figure 3: Property Data Collection Reports from June 2022-July 2023.

In terms of the total valuations (including waivers) the GSEs have processed in the last 12 months, PDCs have made up between 0.17 percent and 0.57 percent of the total, depending on the month.

Despite the incredibly low numbers of PDCs being accepted by the GSEs, over a dozen technology companies and appraisal management companies (AMCs) have been chomping at the bit to develop and roll out a plethora of home measuring applications and an army of property data collectors.

Enlarge image

Figure 3: Property Data Collection Reports from June 2022-July 2023

Perhaps they know something we don’t? In any case, many of the companies that have been vigorously preparing for a world of heavy PDC volume over the last several years must no doubt be—at least for the moment—incredibly disappointed.

Of course, PDCs (or similar versions of them) are currently being used in the private market for portfolio analysis, HELOCs, collateral checks, hard money and investor purposes, and other lender functions, so the fact that the GSEs are barely using them does not mean that there isn’t any business to be had. It is also possible that the GSEs are still running pilot programs that are not being disclosed and hence, not included in the AEI reports.

In response to suggestions by technology company executives that a rapid expansion of PDCs is just around the corner, in private conversations GSE representatives have parroted what Lyle Radke, Senior Director of Collateral Policy at Fannie Mae, has said earlier this year in his public appearances. Fannie Mae is not targeting specific percentages for the use of PDCs—they have an eligibility box and if a loan is within that box, it is eligible. Right now, not many loans are within the eligibility box.

So far, the GSEs seem sensitive (at least somewhat) to the plight of the boots-on-the-ground appraiser and are keeping waivers and PDCs as a smaller percentage of the total volume.

Another consideration is that many larger lenders do not have the systems in place to begin ordering PDCs. Wells Fargo, for example, is currently ordering a full appraisal when given a “Waiver + PDC” option from the GSEs because their systems are not in place to procure PDCs. Consequently, it is reasonable to expect the percentage of PDCs to creep up, even if only marginally, over the next year or two.

What does the future hold long-term? We’ll have to wait and see.

About the Author

Isaac Peck is the Publisher of Working RE magazine and the President of OREP, a leading provider of E&O insurance for real estate professionals. OREP serves over 10,000 appraisers with comprehensive E&O coverage, competitive rates, and 14 hours of free CE for OREP Members (CE not approved in IL, MN, GA). Visit www.OREP.org to learn more. Reach Isaac at isaac@orep.org or (888) 347-5273. CA License #4116465.

OREP Insurance Services, LLC. Calif. License #0K99465

by Jason

Cassandra,

-It is 6 miles months after your comment, do you still feel the same as you did when you posted? Just curious, as I was thinking of joining the profession.

by Dann Cann

My business is off 60 -70%. We are running bare bones as to expendures. We have canceled a number of subscriptions, and are not planning on replacing any equipment on the typical rotation we have used in the past. However I have not laid anyone off and do not intend to. If people are worried if they will have a job stress leads to mistakes. I gave my staff a raise and changed all from hourly to salery so that they know their hours will not be cut. My staff has been with me a long time and deserve to not be afraid if they will have a job in the near term. I have been around a long time and have seen slow downs over the years, however this is the most severe I have seen in my almost 50 years in estimating real estate value.

-Dann Cann

by Cassandra Vaughn

This profession has pushed doom and gloom, the sky is falling since I begain in 1999. And I’ve made a TON of money. I find that my appraisal business is recession proof. I’m needed for every transaction. I find that my business has slowed to a very manageable level.

When we were swamped, we complained. When we are slower, we complain. Goodness. Change your mindset or move on to another profession.

-