|

> CubiCasa

> OREP E&O |

Navigating a Changing Market

by Isaac Peck, Editor

Both real estate appraisers and the real estate market as a whole have been on quite a journey for the last two years. The median price of a home in the U.S. has risen rapidly in the last two years with an average increase of over 30 percent—but some high-demand markets have seen price growth of 50 to 75 percent or more.

During that same time, appraisers have seen record appraisal volume and most have been busier than ever.

However, since the Federal Reserve (the Fed) began raising rates in 2022, the market has begun to shift. The temperature of the market has slowed substantially because of higher interest rates and the number of appraisals being completed is also declining due to a sharp halt in refinance activity.

The result is a shifting market for appraisers—appraisal volume is declining and price acceleration is stalling—and even showing signs of declining in some select markets.

Here are the details on what appraisers are facing and some tips on how to adapt in this changing market.

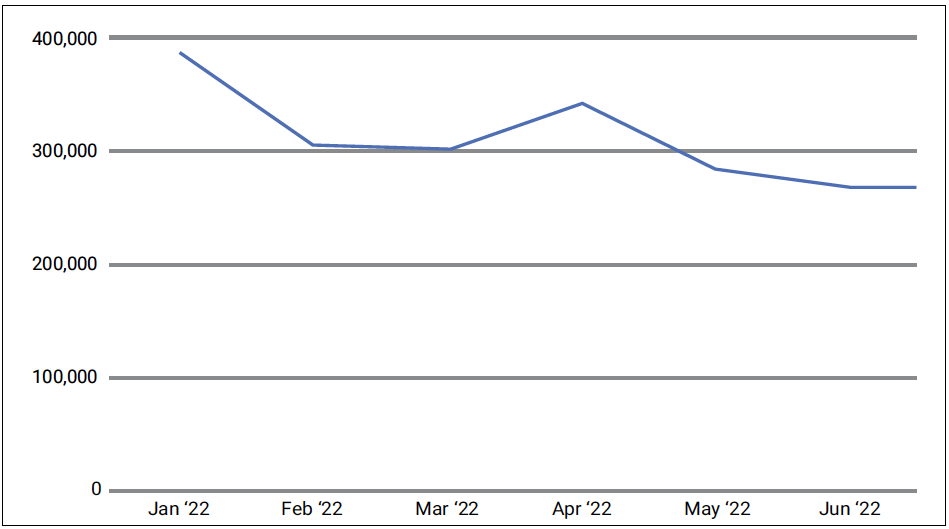

Appraisal Volume

In late 2020 and 2021, appraisal volumes across the U.S. exploded. The number of full 1004 appraisals performed on both a monthly and yearly basis broke new records in 2021.

After an incredible run, the tide began turning in January 2022 and appraisal volume has been steadily declining since then. (See Figure 1.)

Figure 1: Total Appraisals Average / Decline in Appraisal Orders in 2022 (Data from AEI.org)

However, the good news for appraisers is that despite this decline, on the whole, appraisal volume still remains substantially higher than the volume seen in 2017—2018. (See Figure 2.)

Figure 2: Total Appraisals (Blue) versus Total Waivers (Red) – (Data from AEI.org)

In other words, while changing market conditions certainly indicate a further decline in appraisal volume, ultimately what appraisers are experiencing can be best described as a return to normal rather than a complete drop-off in appraisal orders.

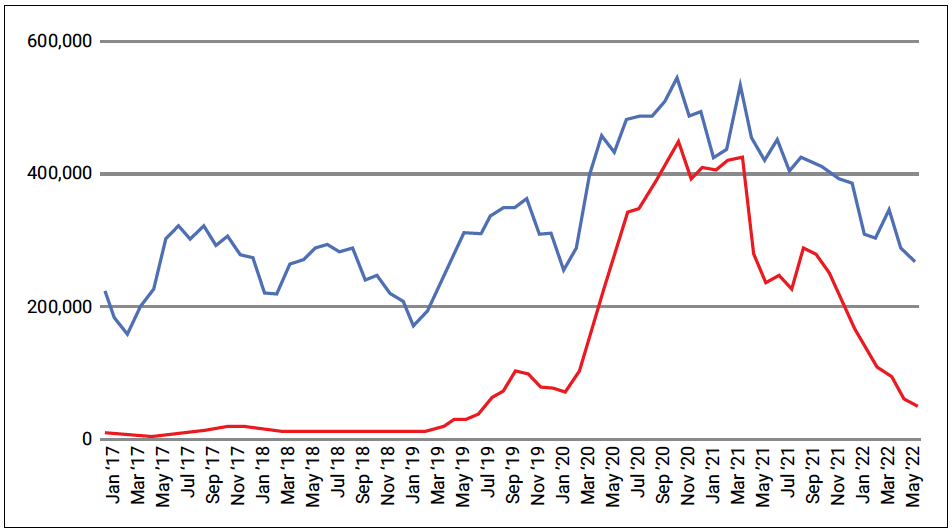

Waivers and Purchases

Another positive sign (in a way), is that appraisal volume has held steady even despite the sharp increase in appraisal waivers over the last two to three years. While the GSEs have massively expanded the use of appraisal waivers, appraisal volume has actually increased during that same time (See Figures 2 and 3.)

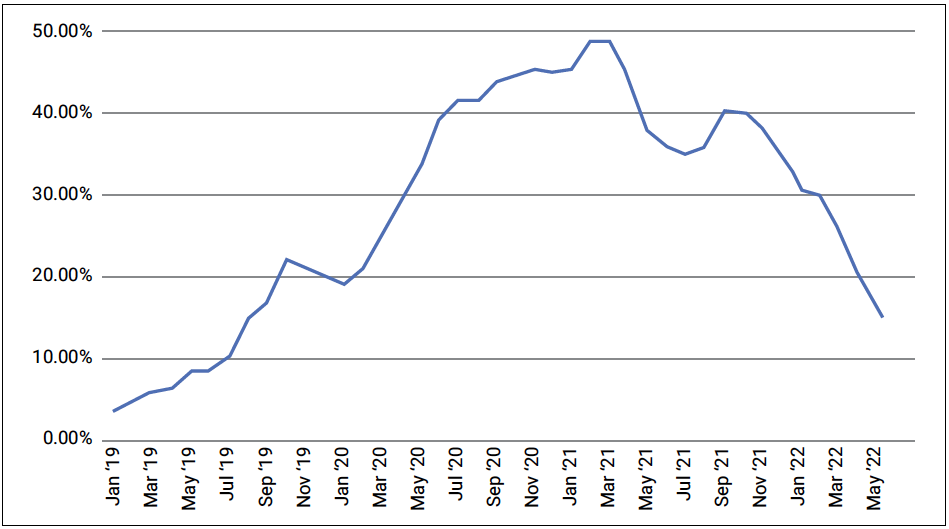

Figure 3: Appraisal Waivers (Data from AEI.org)

Additionally, since appraisal waivers were primarily being used on no-cash out refinances, waivers have retreated substantially since their high point in 2021 when they reached nearly 50 percent of all GSE mortgage transactions.

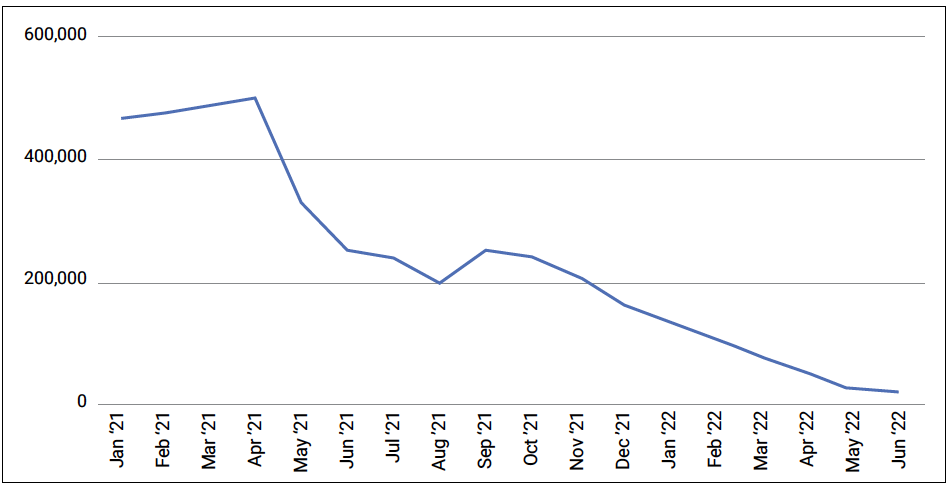

With interest rates skyrocketing, GSE no-cash-out refinances have cratered—dropping from over 500,000 transactions per month in 2021 to under 100,000 starting in March 2022. (See Figure 4.)

Figure 4: No-Cash-Out Refinances (Data from AEI.org)

Use of appraisal waivers have been declining across all types of mortgage transactions with the following product mix average in 2022: (a) 55 percent appraisal waivers used on traditional (no-cash-out) refinances,(b) 30 percent appraisal waivers used on cash-out refinances, and (c) 11 percent appraisal waivers used on purchase transactions.

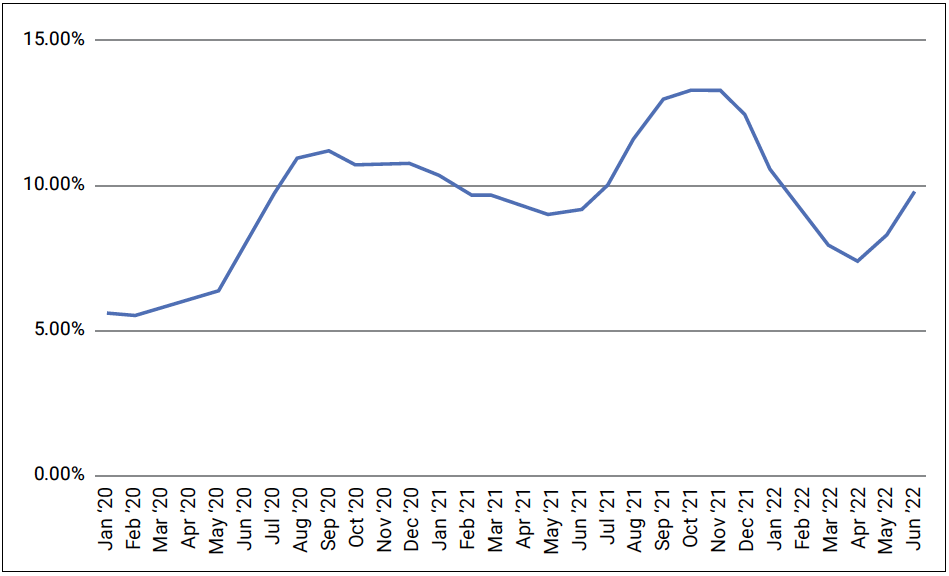

With traditional refinances drying up, the leading indicator of appraisal volume will now be purchase mortgage transactions. Thankfully, appraisal waivers are remaining (for the most part), around 10 percent of purchases. (See Figure 5.)

Figure 5: Appraisal Waivers as Percent of Purchases (Data from AEI.org)

As far as what the future holds for purchase transactions, the National Association of Realtors (NAR) predicts purchase transactions will be down 13 percent in 2022 overall, but expects to see a trend reversal in 2023.

(story continues below)

(story continues)

Fees and Turn-Times

It goes without saying that as appraisal volume declines, the rapid run up in appraisal fees seen during COVID-19 has also seen a small retreat. Appraisers are reporting that many AMCs have returned to their familiar practices of sending appraisal orders out for “bid.”

The practice of “bidding” out appraisal orders is seen by many appraisers as one of the key causes of abnormally long appraisal turn-times and tantamount to an open admission by AMCs that they’re just looking for the cheapest appraisal, not a quality appraisal. “I have just received my fourth request for a bid on the same property. I started bidding on this over one week ago. Today I received the fourth request from a fourth AMC for the same lender,” wrote one appraiser on an Appraiser Facebook group. “I NEVER bid. If everyone would stop answering the emails they would stop sending them & fees would be customary & reasonable. These tactics impact all of us in the long run,” wrote another appraiser.

At the same time, senior leaders at AMCs, lenders and the GSEs have noted that slower appraisal volume will favor those appraisers who can stay in communication with their clients and provide faster turn times. “During the heyday of 3 percent interest rates, it was acceptable for appraisers to take three to four weeks to complete an appraisal and forget to update the client. Now that volume has declined to normal levels, those appraisers who aren’t providing good customer service may see their businesses suffer,” remarked a senior executive at a major bank.

Market Changing: How Appraisers Can Handle

Alongside the discussion of appraisal waivers, appraisal fees, turn-times, and overall appraisal volume, another thing that is increasingly on appraisers’ minds is the changing temperature of the real estate market.

Of course, real estate is always local, but it is now undeniable that the real estate market is slowing down nationally. It’s possible that prices may continue to rise modestly in some markets, but the majority of markets are seeing prices begin to stagnate (with a few declining).

All throughout 2021, and even in the first few months of 2022, buyers were routinely offering $20,000 to $50,000 over list price (at least here in California), but today many sellers are lowering their list prices and buyers are making more modest, negotiated offers.

Ryan Lundquist, a Certified Residential Appraiser and avid blogger at SacramentoAppraisalBlog.com—a top-ranking appraisal blog in the United States, says that in times like these, it is more important than ever for appraisers to cultivate a position of neutrality. “A lot has changed in the last six months with interest rates nearly doubling. There is so much sensationalism floating around—if you watch a bunch of YouTube videos or read articles about how the market is crashing, it’s easy to get caught up in the hype. But as appraisers we need to actively work to remain objective and remain neutral,” argues Lundquist.

Neutrality, Lundquist says, is what sets appraisers apart in tumultuous markets. “It is a battle of narratives for many in the market today—and I really have to fight to stay objective. I don’t want to wear rose-colored glasses and I don’t want to wear doom-and-gloom glasses. People are looking to appraisers now more than ever to tell the truth, report the market, and avoid sensationalism and hype. Some people have been promoting a ‘crash’ for so many years, which really means they’ve been misinterpreting market trends all this time. It’s like they keep repackaging the same prediction until one day they’re right. But in the midst of perpetual prophecies, they’ve lost credibility and shown they don’t really have a pulse on the market,” says Lundquist. The appraiser’s job, then, is to report what is happening in the market right now as objectively as possible. After all, nobody (or very few) people could’ve predicted that COVID-19 would lead to double digit appreciation in real estate prices—many actually predicted the opposite, Lundquist points out.

But just how can appraisers keep a close eye on the pulse of the market? Lundquist recommends finding people in your local market who are parsing trends and doing a good job telling the story. “You can find people like that on YouTube, or perhaps other real estate professionals, and you can even look to the big data companies. Redfin has a great tool where they update stats by the week in a lot of markets across the country. What’s happening with the number of pending contracts? What’s happening with price reductions? Altos Research puts visuals out every single week in most markets across the country. There are a lot of things appraisers can pay attention to,” says Lundquist.

In terms of specific metrics to watch, Lundquist says watching the relationship between listings, sales, and pendings, is a great place to start. “Days on Market, concessions, price reductions, the ratio of listings, to pendings, to sales—all of these are indicators. Price is often the last thing to change in a market. I am much more interested with the number of sales. What’s happening with pending contracts? Are pendings going up or going down? This is indicative of demand. In my market, June pending volume will be down 25 percent compared to last year. We are seeing a huge difference in the number of buyers that are able to play the game right now because of interest rates,” Lundquist reports.

Another part of it is studying the market to the point where appraisers can understand what is normal and what is not for their local market. “We’ve had a really, really aggressive trend for two years; it’s almost unfathomable that a property will take 30 days or longer to sell. So as the market begins to shift, we are getting back to normal in a sense. That doesn’t necessarily mean the market is crashing. I am often looking at stats from 2016 to 2019. Almost all of our recent history has been on steroids and I don’t think it’s a good barometer for interpreting the market overall,” Lundquist says.

Another technique that Lundquist uses is he is always in communication with his peers in the real estate community. “I’m constantly asking people: ‘What are you hearing from buyers and sellers right now?’ Join local forums where people are talking about the housing market. You have to sift through the sensationalism, but hearing people’s stories can be really powerful. Collect as much information as you can and then try to see the forest for the trees. There are a lot of properties getting into contract and there are still multiple offers. These are the trees. But what is going on with the whole forest? What’s happening with the properties that are not getting into contract right away? It’s easy to judge the market based on what’s on my desk if I’m only seeing it through these 10 appraisals I’m working on. But what is the bigger picture?” asks Lundquist.

At the end of the day, Lundquist says his goal is to report what is happening in the market right now—accurately and without sensationalism. “I’m constantly changing what I say in my appraisals and I’m very careful of boilerplate and canned statements. A quick change in interest rates has led to a quick change in the market. My appraisals talk about more stable prices in my area but also about uncertainty regarding the future. Pending volume is softening, available listings are skyrocketing, and it is taking longer to sell—but there are still stats that suggest there is heavy competition for certain homes. It changes by the week. There’s no easy way to quickly do this, it takes effort. There’s no such thing as being a market expert without putting in the time to be an expert,” argues Lundquist.

About the Author

Isaac Peck is the Editor of Working RE magazine and the President of OREP, a leading provider of E&O insurance for real estate professionals. OREP serves over 10,000 appraisers with comprehensive E&O coverage, competitive rates, and 14 hours of free CE for OREP Members (CE not approved in IL, MN, GA). Visit www.OREP.org to learn more. Reach Isaac at isaac@orep.org or (888) 347-5273. CA License #4116465.

Tips for ADUs

Two-Part Demand Webinar On Demand: How to Handle ADUs, Casitas, and Mother-In-Law Units

Presented by: Richard Hagar, SRA Accessory Dwelling Units (ADUs) are a new wave starting in the West and moving all across the United States. Like it or not, they are already in most major cities. Valuing these units is complex!

This Two-Part webinar will help appraisers understand when and where ADUs are allowed, the difference between an ADU and a duplex, how and where to place the information on the form (and which forms should be used), and much more!

Sign Up Now! $79

OREP Members Save

Tips for Smoother Appraising

CE Online – 7 Hours (45 states)

How to Support and Prove Your Adjustments

Presented by: Richard Hagar, SRA

Must-know business practices for all appraisers working today. Ensure proper support for your adjustments. Making defensible adjustments is the first step in becoming a “Tier One” appraiser, who earns more, enjoys the best assignments and suffers fewer snags and callbacks. Up your game, avoid time-consuming callbacks and earn approved CE today!

Sign Up Now! $119 (7 Hrs)

OREP Members: Save 10%

>Opt-In to Working RE Newsletters

>Shop Appraiser Insurance

>Shop Real Estate Agent

Insurance

Send your story submission/idea to the Editor:

isaac@orep.org

by steve gregory mcswain

well said, even printed it

-