|

> The Appraiser Coach

> OREP E&O |

Market Update: How Slow Are We Really?

by Isaac Peck, Publisher

We get it! The market is slow and appraisal volume is down—way down in some areas. But just how slow are we really?

Here are some statistics and graphs to help answer that question.

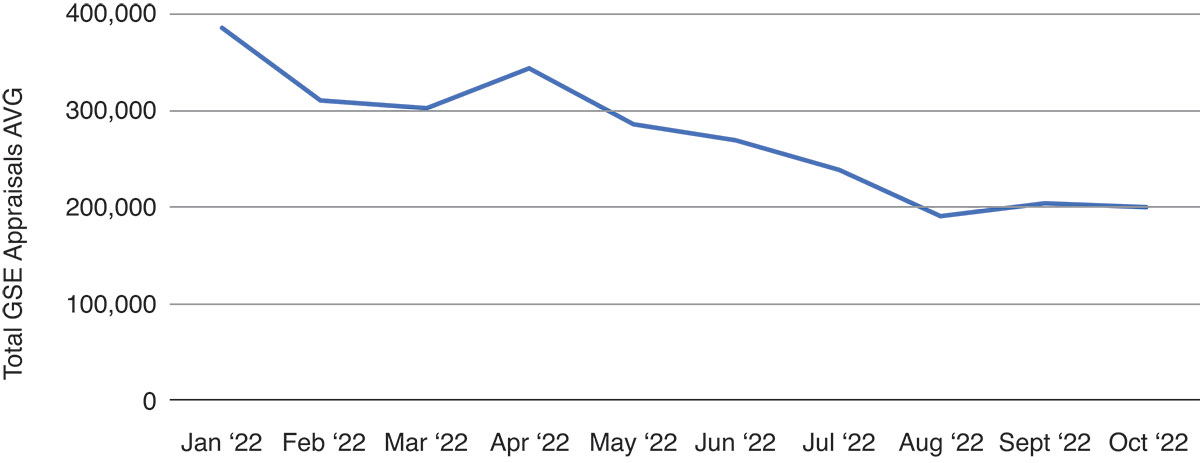

This data is based on information reported by Fannie Mae and Freddie Mac (the GSEs) over the last six years. Appraisers should keep in mind that this data doesn’t capture the entire appraisal landscape, namely, VA, FHA, and private lender appraisal work, but the GSEs handle over 60 percent of all mortgage transactions—which means that the data is largely representative of the market as a whole.

Looking at the appraisal volume numbers from both Fannie and Freddie in 2022, we can see that volume has been cut by nearly 50 percent, from nearly 400,000 appraisals in January to roughly 200,000 in September and 175,000 in October 2022 (See Figure 1: GSE Monthly Appraisal Volume—2022). Please note that these numbers represent actual human appraisals and do not include appraisal waivers, which continue to take up between 15 to 20 percent of all mortgages run through the GSEs.

Figure 1: GSE Monthly Appraisal Volume – 2022

From peak to trough, the GSE data shows a “Peak” of 544,000 appraisals in the month of November 2022. (Some journalists report the peak numbers as between 800,000 to 900,000, but this

author believes those figures include waivers, which accounted for over 45 percent of “valuations” during the peak times). At 175,000 appraisals in October 2022, we’re looking at a decline of 67 percent. In other words, today we have just 33 percent of the monthly volume that we had in late 2020.

Contextualizing the Numbers

Taking a longer view and looking at appraisal volume going back to early 2017 (six years ago), this is not the first time that appraisal volume with the GSEs has dipped to the 200,000 level (See Figure 2: GSE Monthly Appraisal Volume: Last Six Years). In the early months of 2017, 2018, and 2019, the total monthly appraisal volume came very close to the 200,000 level, and in February 2019 it actually dipped to 170,000 appraisals.

Figure 2: GSE Monthly Appraisal Volume: Last Six Years

Additionally, the average monthly appraisal volume for 2018 was 257,500 appraisals, and for 2019 it was 282,600 appraisals per month. Taken as an average, September and October 2022 numbers are 27% below the monthly average for 2018 and 34% below the monthly average for 2019.

It’s also worth noting the local nature of real estate. Across social media, some appraisers have reported a 90–95 percent decrease in their work, while other appraisers have seen a slight slowdown, but still report being very busy. In other words, some markets appear to have slowed down significantly, while others remain fairly robust and healthy.

However, going back as far as the GSEs have been reporting appraisal data (over a decade), 2022 marks the slowest September and October months the industry has seen to-date. Assuming the trend does not reverse, we are likely in for the lowest volume winter months this industry has seen in decades (or ever).

(story continues below)

(story continues)

Desktops and Hybrids?

One question that springs to mind when looking at these numbers is: how many of the actual “appraisals” being reported by the GSEs are traditional 1004s or “full” appraisals, and how many are desktops or hybrids?

The unofficial word from the GSEs is that hybrids and desktops are not accounting for any significant share of total appraisals. Hybrid appraisals, they say, are still in beta (test) mode and are only being deployed in select markets by a few of their closest partners.

On that note the GSEs have begun reporting an additional category in their appraisal data called “Onsite Property Inspections.” The GSEs report that 486 of these “Onsite Property Collection” reports were performed in July, 586 reported in August, 1143 in September, and 940 performed in October. One can only assume that these “property collections” are a form of hybrid that the GSEs are testing with a few select partners.

Waivers

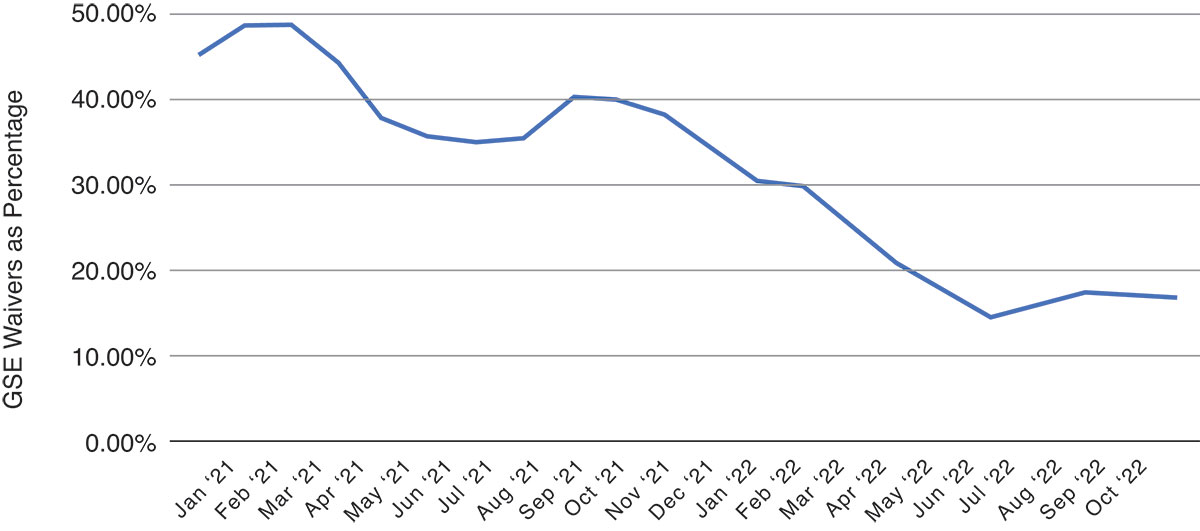

The use of appraisal waivers has been drastically curtailed over the last two years—dropping from nearly 50 percent of all GSE mortgage transactions and now hovering around 15 to 17 percent (See Figure 3: Appraisal Waivers as a Percent of All Valuations). This is explained, in part, by the drastic reduction in rate-and-term (No Cash-Out) refinancing. From a high of over 500,000 rate-and-term refinances in November 2020, the GSEs saw less than 9,000 rate-and-term refinances in October 2022.

Figure 3: Appraisal Waivers as a Percent of All Valuations

There are two other key data points to note regarding waivers. The first is that use of waivers on Purchase transactions is at an all-time high amongst the GSEs. Roughly 15 percent of Purchase transactions received a waiver–up from an average of 10 to 12 percent during 2020 and 2021.

Takeaways

The key takeaways here are that appraisal volume is down, but should be read in context. The slowest months we’ve seen so far in 2022 are not the slowest months appraisers have seen in the last 5 years (See February 2019). The use of waivers is down substantially overall, but has been creeping up with respect to Purchase transactions. One bit of good news is that desktop and hybrid appraisals are not yet taking up any significant share of “human” appraisals.

Appraisers can likely expect to see low volume for the foreseeable future, but we’ve seen similar slowdowns before. The market is cyclical and one thing is certain—everything changes. It won’t be like this forever.

About the Author

Isaac Peck is the Editor of Working RE magazine and the President of OREP, a leading provider of E&O insurance for real estate professionals. OREP serves over 10,000 appraisers with comprehensive E&O coverage, competitive rates, and 14 hours of CE at no charge for OREP Members (CE not approved in IL, MN, GA). Visit OREP.org to learn more. Reach Isaac at isaac@orep.org or ( or (888) 347-5273. Calif. Lic. #4116465.

OREP Insurance Services, LLC. Calif. License #0K99465