|

“One of the best courses that I have had in 17 years!” -Amy H

> OREP E&O |

Editor’s Note: Share your experience with trainees in Working RE’s Survey for Trainee Supervisors and help the entire industry. Take the four-minute survey now.

First Discrimination Lawsuit: What it Means for Appraisers

by Isaac Peck, Editor

As you likely already know, the first discrimination-based lawsuit against an appraiser (at least the “first” in recent history) was filed in December 2021 against Janette Miller, an individual appraiser, and AMC Links, LLC, an appraisal management company (AMC), in the U.S. District Court of Northern California.

The lawsuit was filed by a Black family in Marin County, California and alleges that Miller, a white appraiser, undervalued the plaintiff’s home by nearly $500,000, that race was a motivating factor in her appraisal, and that she committed multiple violations of the Fair Housing Act.

As the first formal lawsuit filed alleging discrimination, this case fleshes out some of the key accusations that are being leveled against appraisers and how these charges are interpreted by the courts will no doubt have far-reaching implications and have a critical role in how this issue continues to play out on a national level.

Here is a deep dive on the details of the case and an analysis of the arguments being leveled against the appraisal profession. Trigger warning: this is a controversial subject.

Backstory

Tenisha Tate-Austin and Paul Austin, black homeowners, purchased their home, now nicknamed “the Pacheco house,” in 2016 and immediately began making improvements, including enlarging two rooms, updating appliances, adding a deck, and even a gas fireplace. The Austins had previously refinanced their house in 2019 and had received an appraisal valuing the house at $1.4 million. Seeking to refinance again in 2020 because of lower interest rates, the Austins were expecting the appraised value of their home to have risen compared to the year prior.

However, in 2020, Janette C. Miller, a licensed real estate appraiser hired by AMC Links LLC, appraised the Austin’s home for only $995,000, nearly one-third less than the appraised value the Austin’s had received the year prior.

The Austin’s were understandably shocked and disappointed and decided to run an experiment. They took down their family photos, their African art, hid CDs, and concealed any other indicators that a Black family lived there. Then they ordered a second appraisal to be done and they asked one of their white friends to pose as the homeowner. The Austin’s new appraisal came in at $1.48M—nearly a half a million-dollar difference.

In response, the Austins filed a lawsuit against Janette Miller and AMC Links, LLC. In their lawsuit, the Austins were joined in their case by the Fair Housing Advocates of Northern California, a non-profit dedicated to fighting discrimination in housing.

Factors at Play

As appraisers, industry stakeholders, homeowners, and the local and national news outlets discuss discrimination and bias within the appraisal profession, there are several distinct accusations that are leveled against appraisers:

- Individual actors (appraisers) who are either consciously or unconsciously biased/racist

- Lack of diversity in the appraisal industry (90%+ of appraisers are white)

- Appraisal practices in general are racially bias or perpetuate discrimination

Whether analyzing this particular case, or the dozens of other cases that have been covered by local and national news outlets over the last two years, part of the conversation centers around whether an individual appraiser in question is, in fact, consciously or unconsciously biased. With so many cases making the news in the last two years, some appraisers have publicly questioned whether an appraiser might simply be incompetent, instead of biased.

However, the other part of this conversation revolves around the appraisal profession’s practices and processes themselves. If an appraiser is merely reflecting the market, is that biased?

If an appraiser accurately reflects what a motivated buyer is willing to pay for a home on a particular street or in a specific neighborhood, does that perpetuate discrimination?

In their lawsuit and in their comments to the press, the Austins have strongly suggested that Miller herself may have been consciously or unconsciously biased, but their legal arguments go well beyond simply attacking Miller as an individual appraiser. The core of the Austin’s lawsuit raises key allegations against long established techniques and practices of the appraisal profession today—such as defining neighborhoods boundaries and the use of the sales comparison approach.

(story continues below)

(story continues)

Allegation #1: Prioritizing Comps from the Same Neighborhood = Racial Bias

The Austin’s lawsuit advances an argument that is at the heart of many of the accusations being leveled against mainstream appraisal methodology. While the subject property (the Austin’s home) was located in Marin City, an unincorporated community in Marin County, the suit argues that because Miller used comparables primarily in Marin City, that in itself is evidence of racial bias.

The suit reads:

“Appraising a house located in Marin City, such as the Pacheco Street House, using comparisons of other property sales located exclusively or primarily in Marin City results in a skewed and race-based valuation of the property…Using Marin City sales as the primary source of comps is evidence of racial bias – i.e., that the appraiser believes that Marin City’s demographics make it so much less ‘desirable’ than surrounding areas that property in those areas cannot be used as comps.”

In other words, the mere act of using comps from the same neighborhood is “evidence of racial bias,” according to the legal theories behind the Austin’s lawsuit. Let’s dig into the reasoning behind this argument.

The lawsuit goes to great lengths to detail how the racial and economic composition of Marin City is the product of historical discrimination. The suit explains that housing was first developed in Marin City in the early 1940s to house workers who migrated to work in the Sausalito shipyards. “Many of the shipyard workers were Black but they lived alongside whites and Asians as well. After the end of World War II, shipbuilding jobs weren’t as needed and jobs declined, so many workers ended up unemployed,” the suit reports.

White residents moved away in search for better employment, aided by the FHA through bank loans that “were designed to move white residents to all-white neighborhoods that would remain all-white through the use of racially-restrictive covenants,”i.e. redlining.

Most Black residents had to stay in Marin City due to “housing discrimination, racially-restrictive covenants, redlining, denial of access to government-backed financing, and other forms of discrimination, “the suit reads. Today, black residents make up 35.8% of residents. It is against this backdrop of historical discrimination that the Austin’s are advancing their argument. In other words, because the black residents of Marin City have been discriminated against and have been victims of redlining for the last 70 to 80 years, the values of houses in Marin City are a product of historical discrimination. And because the values of houses in Marin City are a product of historical discrimination, if an appraiser is appraising a property in Marin City and looks primarily to Marin City for comparable sales, that is an act that “perpetuates discrimination “and shows “evidence of racial bias.”

This line of reasoning will undoubtedly leave most appraisers befuddled. After all, appraisers typically prefer to select comparable sales (comps) in the same neighborhood because those comps are the closest representation of what market participants are willing to pay for a property in that particular neighborhood, with access to those particular schools, with those specific neighborhood amenities, shopping centers, and so on.

Appraisers are hired to provide an opinion of “market value, “which is defined by Fannie Mae as “the most probable price that a property should bring in a competitive and open market under all conditions requisite to a fair sale, the buyer and seller, each acting prudently, knowledgeably and assuming the price is not affected by undue stimulus.”

The dilemma for appraisers is clear. If homes in a historically black neighborhood are consistently selling for lower prices than surrounding neighborhoods that are predominantly white—what is an appraiser to do?

After all, appraisers are hired to reflect the market. If the market reflects the impact of historical discrimination, or if the market continues to reflect ongoing discrimination and segregation, should the appraiser ignore what the market is saying?

Allegation #2: Sales Comparison Approach is Racist

The second key allegation in the Austin’s lawsuit is that the use of the sales comparison approach perpetuates discrimination. This argument builds on the critique of neighborhood boundaries above.

Reiterating the history of redlining, the lawsuit explains how the history of housing discrimination had longstanding effects on black neighborhood home values. The lawsuit also points out that appraisal standards contained explicitly race-based valuation standards until the United States Department of Justice (DOJ) sued the American Institute of Real Estate Appraisers (AIREA) and related defendants in 1976 under the Fair Housing Act.

But that didn’t fix the situation, the lawsuit argues. “The damage was already done. Property in Black neighborhoods and racially diverse neighborhoods reflect these low valuations that appraisers were trained to make. Most appraisers continue to evaluate a house’s value by comparing it to houses in similar, proximate neighborhoods that have sold in the recent past (comps),”the lawsuit reads.

Similar to their attack on neighborhood boundaries, the Austins argue that the historical discrimination that black and racially diverse neighborhoods experienced means that the use of the sales comparison approach perpetuates that discrimination.

The suit reads: “The continued use of the sales comparison approach recycles home values that were initially determined using explicitly race- based criteria, and compounds the effects of decades of undervaluation of homes in non-white areas. Likewise, some appraisers, including defendants, have continued to use race-based criteria in assessing property value, including limiting comparisons to houses within areas of similar racial demographics and valuing predominantly white areas more highly than other areas.”

Just like the critique of neighborhood boundaries, this attack again turns appraising on its head. Normally, an exact model match that sold on the same street two houses down from the subject property would be considered the perfect comp. If using a comp on the same street as the subject property is “evidence of racial bias”—then the very foundation on which the appraisal profession is built is being questioned. What is an appraiser to do?

(story continues below)

(story continues)

Origin of Arguments

The arguments being advanced by the Austins are not new. In fact, the allegations so passionately argued in the Austin’s lawsuit bear much resemblance to position papers that have been recently written by academics.

While there has been much discussion over a report published by the Brookings Institute titled “The devaluation of assets in Black neighborhoods” by Andre Perry et al, it is actually one of the sources that is cited by Perry’s article that lays out the deeper arguments that have been leveled against the appraisal profession.

One of the articles that Perry cites in his much debated report is: “The Increasing Effect of Neighborhood Racial Composition on Housing Values, 1980–2015,” by Junia Howell and Elizabeth Korver-Glenn.

Published in 2020 by the Oxford Academic, Howell, a PhD candidate studying Philosophy, and Korver-Glenn, an Assistant Professor with a PhD in Sociology, advance the following arguments:

- Using previous sales without correcting for the fact that these values had been derived under an explicitly racialized system ensured the historical hierarchy was preserved.

- We conclude contemporary appraising practices contribute to ongoing inequality. We argue they do so in two ways. First, the continued use of the sales comparison approach after fair housing legislation meant appraisers used previous sales, which explicitly relied on neighborhood racial composition, to determine appraisals. Since no steps were taken to rectify the historic inequities, this approach has enabled such inequalities to persist. Second, appraisers continue to use neighborhood racial composition to help determine which homes are comparable.

- At the policy level, we propose swift, dramatic interventions to transform the existing appraisal landscape. New regulatory legislation should decouple neighborhood demographic characteristics from home values and appreciation rates.

Taken in context, portions of President Joe Biden’s housing policy positions, Andre Perry’s report, as well as large portions of the Austins’ lawsuit, seem to draw on, or at the very least, contain striking similarities to the arguments advanced in this article by two academics who specialize in Philosophy and Sociology.

In fact, the Austin’s lawsuit appears to be a proving ground for the exact same arguments that were advanced by Howell and Korver-Glen two years ago.

Appraisal Changes/Reparations

The dilemma facing appraisers is that the academic critique of the historically racist policies in the United States, ultimately conclude with a call for reparations—which is defined by the Oxford Dictionary as: “the making of amends for a wrong one has done, by paying money to or otherwise helping those who have been wronged.”

Here it is in Howell’s and Korver-Glenn’s own words:

“Policy makers need to consider how we can collectively offer reparations for explicitly racist housing policies that contributed to the systemic hyper-valuing of White neighborhoods and de-valuing of neighborhoods of color (especially between the 1930s and 1970s). Such considerations should also grapple with the dramatic divergence in home appreciation rates observed in the last 35 years: since 1980, homes in White neighborhoods appreciated $194,000 more than comparable homes in otherwise comparable communities of color.”

California actually has recently convened a “first-in-the-nation” Reparations Task Force that is charged with “recommending how California will issue a formal apology, how to eliminate discrimination in existing state laws, and determine how any potential compensation should be calculated for the descendants of enslaved persons in the U.S. and who would be eligible.”

In case there was any doubt about its relation to this case in particular, the CA Reparations Task Force invited Paul Austin, one of the plaintiffs in the lawsuit, to be one of the keynote speakers at a recent Reparations Task Force meeting.

When asked what it meant to him to be sharing his story of appraisal discrimination with the California Reparations Task Force, Paul Austin replied: “It’s such an honor. But what’s most important, I think, is we might actually be able to see some real tangible change.”

This idea of reparations, or “righting the wrongs of the past” was also addressed in Bill H.R.2553—Real Estate Valuation Fairness and Improvement Act of 2021. After outlining that the government is, in part, responsible for “harmful consequences of discrimination,” the bill proposes, as the solution, the creation of a national Task Force to right these historical wrongs.

Among other things, the Task Force would create specific definitions for limited or inactive housing markets in which comparable sales are “limited or unavailable over a certain period of time.” Once defined, the Task Force will “establish greater flexibilities and guidance for appraisals and any underwriting processes associated with appraisals conducted in such markets, such as the ability to consider market evidence for similar properties in other geographic areas or utilizing a range of value.”

In other words, the Bill as written would mandate alternative guidelines for appraisers to encourage them to (1) ignore neighborhood boundaries, and (2) significantly alter the definition of a “comparable sale”–all with the goal of addressing the wrongs of the past.

Reparations is no doubt an incredibly contentious, polarizing issue in the United States. But whether you agree with the idea of reparations, the trouble with framing appraisers as the problem and then posing reparation as the solution, is that it places the burden of reparations solely at the feet of appraisers.

Many appraisers feel that placing the responsibility of righting the many wrongs of America’s historically racist past, squarely on appraisers’ shoulders is not fair–and perhaps more importantly, it’s just not realistic.

The old adage, appraisers don’t make the market, they just report it, might be worth revisiting.

What about USPAP?

Another dilemma that appraisers face is that they are being asked to simultaneously provide special treatment to black and racially diverse communities, while also being tasked with not seeing or using race at all.

For example, in the Austin’s own lawsuit, when naming AMC Links, LLC, the AMC responsible for placing the appraisal order with Miller, the Austins point out that California law requires an AMC to “review the work of all…appraisers with whom it contracts to ensure that appraisal services are performed in accordance with [USPAP].”

In other words, the AMC has liability in this case, the Austin’s argue, because they are responsible for ensuring compliance with USPAP under CA law.

The Conduct Section of the Ethics Rule in USPAP states that an appraiser:

- must not use or rely on unsupported conclusions relating to characteristics such as race, color, religion, national origin, gender, marital status, familial status, age, receipt of public assistance income, handicap, or an unsupported conclusion that homogeneity of such characteristics is necessary to maximize value.

So on the one hand, appraisers and AMCs are being asked to follow and uphold USPAP, but on the other hand, the underlying criticism of appraisal methodology that is taking place in academia as well as in Congress, is a philosophical critique that ultimately calls for reparations.

But how are appraisers supposed to avoid the “use” of or “reliance” on conclusions relating to race or color if they are also being expected to provide reparations for the discriminatory housing practices of the past?

If appraisers are not allowed to use race at all, how do they know when to eschew the use of the sales comparison approach or neighborhood boundaries and when those methods are allowable?

Conclusion

The issues raised in the Austin’s lawsuit, as well as those raised by Bill H.R.2553, admittedly create more questions than answers for the appraisal profession.

Based on the suit, the facts of this case show the following:

- In 2019, the Austin’s home was appraised for $1.4M

- In February 2020, Miller appraised the Austin’s Home for $995,000

- In February 2020, a third appraiser appraised the Austin’s home for $1.48M

So Miller is definitely in the “minority” (excuse the pun) as far as accurately valuing the Austin’s home. Her appraised value contains a large discrepancy between two of her peers. Why did Miller’s appraisal vary so widely from the opinions of two other appraisers?

As far as the larger critiques of appraisal methodology, much depends on how the courts interpret the Austin’s claims and whether Congress manages to pass sweeping legislation that will come up with alternative valuation methods and mandate appraisers to “consider market evidence for similar properties in other geographic areas.”

Without significant changes in appraisal standards and/or national laws, appraisers seem to be caught between a rock and a hard place. On the one hand they are being told to follow USPAP and never to use race in their appraisal, and on the other hand they’re being told that when they’re appraising in black or racially diverse communities, that to rely primarily on comparable sales that are in that community “perpetuates discrimination.”

The issues of racial discrimination in appraisal, the lack of diversity in the appraisal industry, and the prospect of biased and/or incompetent individual appraisers are incredibly important, but difficult, problems that the industry will continue to struggle with.

In the meantime, appraisers will be watching with bated breath how the Austin’s lawsuit plays out in court and whether Congress decides to take action—potentially changing appraisal standards as it relates to racially diverse communities.

This is a developing story. Don’t miss Working RE’s story next week as we dive into the written response by the attorneys for Janette Miller, the appraiser defendant in this case.

About the Author

Isaac Peck is the Editor of Working RE magazine and the President of OREP, a leading provider of E&O insurance for real estate professionals. OREP serves over 10,000 appraisers with comprehensive E&O coverage, competitive rates, and 14 hours of free CE for OREP Members (CE not approved in IL, MN, GA). Visit www.OREP.org to learn more. Reach Isaac at isaac@orep.org or (888) 347-5273. CA License #4116465.

Tips for Smoother Appraising

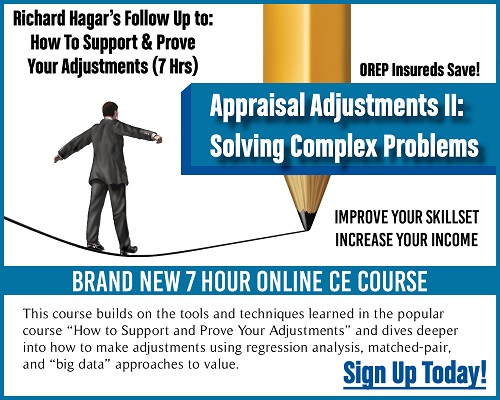

CE Online – 7 Hours (45 states)

How to Support and Prove Your Adjustments

Presented by: Richard Hagar, SRA

Must-know business practices for all appraisers working today. Ensure proper support for your adjustments. Making defensible adjustments is the first step in becoming a “Tier One” appraiser, who earns more, enjoys the best assignments and suffers fewer snags and callbacks. Up your game, avoid time-consuming callbacks and earn approved CE today!

Sign Up Now! $119 (7 Hrs)

OREP Members: Save 10%

>Opt-In to Working RE Newsletters

>Shop Appraiser Insurance

>Shop Real Estate Agent

Insurance

Send your story submission/idea to the Editor:

isaac@orep.org

by Jack nashville

Now what is contemplated damage if it is known that the “offended” couple had some undisclosed additional facts such as they couple bought the house in 2016 for less than $650k and had spent less than $200k in rehab, maint, renovation cost… Now how would that hinky up the “victim’s” scenario??? oooops

-by cheryl.enders@summitfunding.net

I am a staff review appraiser for a mortgage banking company. I saw an appraisal come in for a home in a white neighborhood at $1,200,000. This appraisal was deemed flawed and not because of value. We had to get another appraisal. The next one (done 2 months later) came in at $2,350,000. Racial bias? No.

-by Alan+Getch

The “TRUTH” is that the three most important things in Real Estate have been long known. LOCATION, LOCATION, LOCATION.. This is insanity and political correctness at its extreme.

What ever the original appraiser did (Who says she was wrong? Yes two other appraisers came in higher, but would they have been the wrong ones if they had come in lower?) not with standing. Our job is to read the market, not manipulate it. And when doing our jobs correctly, we can’t manipulate it. So with the theories promoted by this law suite we should say that it is just not ok, but required to leave a neighborhood to find higher priced sales (which was part of the reason for the Mortgage Crash of the mid 2000’s), but only if the neighborhood is of a certain racial make up which is illegal for us to even notice. Again, this is insanity. If you have three houses on the same street that are identical and sold for $100K, $102K, & $105K, are we supposed to ignore them and come in at $125K based on irrelevant data down the road to correct something that happened before some of us were even born?

They want to get rid of the comparable sales approach (the most accurate approach) and use what? Income? Well the rents will be cheaper where the houses are cheaper. Racism! How about cost approach? Nothing more reliable than appraising a run down 1920’s cottage than the Cost Approach. Give me a freaking break!

They want to do reparations, then do it in underwriting and just add 10% (or what ever) to every appraisal value of those these academics feel are worthy (Those who can do, those who can’t teach) .

Oh, and what kind of racism will the appraiser be blamed for when the values of certain neighborhoods are artificially raised for these reparations which causes people to no longer be able to afford to move into these neighborhoods. Ahh, the unintended consequences. No problem, it’s an underwriter issue. If you are buying a house the underwriter just subtracts 10% from the appraised value as reparations. But if you are doing a ReFi, then add the 10% as stated above. Oh hell with it. Just stop doing appraisals and hand out the money based on their credit and repayment history. Whoa there says everybody. We can’t do that. I will guarantee you the academics will say that to do so would be racist.

Not once in my 35 years have I ever gave a damn who owned the house, or took race into consideration. But your damn right I used sales from the neighborhood, not because I’m a racist because those sales ARE the indicators of the market for that house. Not the sales across town even if that neighborhood has the same racial make up which I wouldn’t know anyway, because race is irrelevant. Location, Location, Location is what’s relevant.

Ignoring the facts does not fix a problem that may or may not even exist. It’s just lying!

This whole thing is just Fooey I tell you Fooey, and insanity run amok.

-by Greg

I’m not white, but I am an “average” appraiser. I’ve been an appraiser for over 30 years and I’ve personally experienced racial discrimination (not in appraising or lending arenas). My immediate family is multi-racial (Black, White, Asian, Hispanic).

Allow me to address the elephant in the room. I don’t know the details of what actually transpired in this appraisal situation, but I do know the following. The suit is emblematic of the discord, divisiveness and confusion that’s permeated our society in the last few years. It’s not just an appraisal issue.

This is one more example of the “equity” sickness that’s been allowed to spread and that has been promoted throughout our whole society by our senior leadership at almost every level of government and our institutions.

The pursuit of “equity” sees everything in life through a biopic view of racism and promotes the belief that equity of outcome (instead of equality of opportunity) is the societal goal. It ignores accurate facts, historical accuracy, and true (root) causes and you end up with absurdities such as what is presented in this article. Logic, accuracy, and the truth is blinded and ignored to feed the monster.

This is much more than a racial discrimination lawsuit in the appraisal industry. The perpetual pursuit of “racial equity” won’t stop until Americans of all backgrounds and races say enough-is-enough, and vote/promote sane leaders in our country and institutions that do not seek to divide and malign our country and it’s citizens.

I’ve traveled all over the world and I firmly believe this is the best country in the world. If we fail to act and speak up, then we have no one but ourselves to blame when we become a lesser nation.

-by John

Greg,

-Excellent points made with sounds logic. Equality of opportunity, not outcome, is necessary for building/maintaining a robust free society/country. But it takes hard work and self discipline, currently in short supply. :-/

by T LOVING

Well said, thank you. It”s interesting how this all has come up after the media got ahold of the suggestion. And if discrimination is true in this case or any case, action should be taken.

-by Charles Williamson

The facts are that there is no discrimination in this case……..the only thing we have is perceived discrimination because the appraisal came in under the borrower’s expectations. This happens everyday regardless of race. My 2 cents!

-by Rob Engle

This article by Mr. Peck is the best I have seen so far on this topic.

-One thing that has occured to me recently, and I’ll post here for others to consider:

–

The government (FHFA) has sometimes conducted sting operations against real estate companies and/or individuals when the FHFA receives credible complaints of violations of the Fair Housing Act and related laws.

And when the FHFA also obtains incriminating evidence, enforcement actions are taken and penalties are imposed.

These are legitimate and (in my opinion) necessary actions to ensure that our laws are followed and the civil rights of citizens are protected.

But in every case, you will find the following:

1) It is the government that conducts the investigation

2) Penalties are imposed on the offending companies and/or individuals… and only after the accused are afforded judicial proceedings.

If found guilty, penalties may include loss of license and ability to work in the profession…. but NOT on an entire industry, just the offending companies/individuals.

—

NEVER (to my knowledge), has the US government:

1) Declared an entire industry of professionals to be guilty of bias

2) Made policy changes which severely restrict this entire class of workers from practicing their profession…. at the same time that they grant other companie$ or individual$ the right to replace them.

3) Taken both of these actions based NOT on the government’s own thorough & transparent investigations, but based upon nothing more than heresay and media stories.

by Mary Cummins

Great article. Thanks for writing it. The allegations are truly bizarre. It’s clearly a frivolous lawsuit.

-by Robert

Has anybody ever read the Brookings report? Their data and conclusions from one source: ZILLOW. Sadly, in accordance with the “woke” society we live in, the Austins have hit the legal lottery and will most likely prevail in their lawsuit. Also, I’d be willing to bet the person the Austins got to stand in for them made sure the 3rd appraiser knew about the low value of the Ms Miller’s appraisal. Having been properly influenced and instead of doing his/her job, the 3rd appraiser made sure to hit a higher value….

-by Jim Anderson

Robert,

-I’m betting you are right. Someone along the way told or hinted to the last appraiser that there was a value issue.

by HouseDog

OK. How about this to solve the problem and of course, we get much higher fees. Since the Fannie computer knows the demographics of neighborhoods, it chooses for the appraiser what neighborhoods to analyze in the report with several different opinions of value. EG: In the subject neighborhood the opinion of market value of the subject is $XXX. If the subject was located in Neighborhoods A, B and C, the opinions of market value are $XXX. What they do with those opinions of value to lend on is not the appraiser’s problem. We provide opinions of value, they decide the terms of the loan…

-by HouseDog

It would be very interesting to see what comps the Fannie computer suggested for use to the underwriter and if they were analyzed by the appraiser. Then they could sue Fannie for discrimination also…LOL

-by Jeff

My guess is that this situation is not actually racism but merely more evidence that demonstrates how appraisal management companies undermine appraisal quality. Here’s what I think really happened here:

-1) the 2020 lender hired middleman-AMC to procure a refinance appraisal

2) middleman-AMC chiseled dirtcheap-appraiser into doing an appraisal for half-off (middleman-AMC charged lender full fee and kept the other half)

3) dirtcheap-appraiser rushed through the work by low-balling a non-credible opinion of value regardless of who owned the house (appraisers only get scrutiny for pushing value right?)

4) the second “white-borrower” appraisal was done by a decent-appraiser (who received full-fee and thus developed a credible opinion of value regardless of who owned the house)

5) in this case the “black-borrower” “white-borrower” stuff was just an irrelevant sideshow that masked the real problem of AMC middlemen swindling lenders and appraisers

by Patrick Egger

Per your article, the Austins purchased the home in 2016 and refinanced their house in 2019, getting an appraisal (from appraiser A) at that time for $1.4 million. After Miller appraised the home in 2020 for $995,000, The Austins got a second opinion (from appraiser B) that came in at $1.48 million, or $80k above the 2019 appraisal.

It would seem to me we have two appraisals that concur with a value above $1.4 million, while Miller is well below that mark. No bias or racist issues is alleged with appraisers A or B. It would seem the problem is with Miller, not with appraisers in general. If appraisal theory and practice (and appraisers in general) is inherently biased and racist, how did the Austins get values of $1.4 and $1.48 million?

It seems to me Miller is the outlier (based upon the other two appraisals) and therefore it is incumbent upon her to prove that she is right, and the others are wrong. If she cannot, the case is against her. They may be trying to make this a bigger issue when their own evidence (appraisals A&B) confirms it is not.

-by T LOVING

Right, but what I find is that the homeowner often makes their own biased comments to the “new” appraiser; ” Appraiser X came in 30% below another I had done three years ago”…and thus knowingly puts pressure (which we are SUPPOSED to withstand) on Appraiser Y. Adding that the borrower may suggest to either of the subsequent appraisers that racial animus is involved could really pressure an appraiser to come in at value. Yes, we are supposed to decline if such pressure is exerted, but it happens often.

-by Dave

It shouldn’t be majority rule, it should be credibility. You can have two target hitters both have reports that are not credible, that is not a reason for a third peer to match them.

-by Mike

The house is the lender’s collateral for the loan. Every appraiser should ask themselves the following: If the property I’m appraising becomes an REO how is the market going to value it, what factors will the market consider? This is where the rubber hits the road. The case arguments against current appraisal methodology are absurd & illogical, and if adopted, would result in chaos and have catastrophic consequences, making the last credit crisis look tame by comparison. Obviously someone made a mistake here, but be careful not to make an early judgement till we know WHERE the comparable sales are located in all three appraisals.

-by FRED VANDER WAL

I’ve always felt 1) I’m protecting the lender and 2) I’m putting myself in a buyer’s shoes. Intelligent buyers don’t want to overpay for a house. If the house in question didn’t support 1.4 million than why would a buyer pay it? And as another commented; if I don’t use the house next door that sold for 950,000 I’ll get taken to task. This article made me think of quitting appraising. There is no win here. Wokism has ruined damn near everything. I hope the Austins are also seeking reparations for all the poor white folk in poor white neighborhoods who evidently also suffer from discrimination.

-by Michael G Weinert

The main question to answer is what comps were used or eliminated by the 3 appraisers.

-Did the appraisers that came up with 1.4 million go out of the narrower Marin market for comps? Was the subject unique in some way that it was necessary to go out of Marin. 2 appraisers came up with comps that led to a higher value, why were those included. 2 reports were done close enough in time that each should have recognized theses sales and had reason to include or eliminate them.

I have appraised houses unique to a neighborhood and had to go out 6 to 10 miles to a similar neighborhood for the best comps, obviously this requires significant explanation.

With 2 out of 3 being on the same page I can only speculate the 3rd appraiser let Fannie guidelines for proximity inhibit the comp selection; Yes it is easier when the guidelines actually do fit the process, however there are many properties where an appraiser must through away the Fannie book to get a reasonable set of comps, and reliable relatively reliable estimate.

I doubt the outlier was racist, just less experienced with the property type.

by Dan Fields

Racial discrimination and bias by appraisers cannot be tolerated. It ruins the very essence of public trust.

-by Scott Gang

how, exactly do you know there was racial discrimination? Selecting comparable sales within the closest proximity to the subject is the correct methodology. It is NOT the appraisers job to cure racial bias via using methods outside of norms. If there should be reparations, it should be done in another method.

-by Mark Lee

You’re both correct. Racial discrimination and bias cannot be tolerated and how exactly do you know? The lower Appraisal? The 2nd lower Appraisal opinion seems like it’s not correct (based upon the 1st & 3rd Appraisal); however, as someone that has evaluated properties for almost three decades I’d have to actually review the data (including interior and exterior photos of the subject and comparable property improvements). External influences would also have to be considered including traffic patterns (distance to commercial/multi-family properties, parks, mountain/water views). The question being what are the “most appropriate” “like unto like” comparable properties? Does the 2nd Appraiser’s comparable properties have merit or are they simply wrong? Was there a more appropriate comparable property(s) skipped or over-looked by the 1st, 2nd or 3rd Appraiser? If the subject property were put on the market this could be solved real quick! What if the subject were to sell for $1,100,000 or $1,200,000 and the Lender takes a loss? Appraiser 1 & 3 liable?

-by George C Hoez, Jr. Pa appraiser

How come we do not know where all the sales are located. And it is not the appraiser’s job to ignore sales in the same neighborhood. That is exactly how a property is misrepresented when an appraiser ignores sales in the subject neighborhood in order to inflate the value. Anyone who has done extensive review work sees that way too many times

-by Scott Cullen

Thanks Isaac. Very well written. Here’s today weather for Minneapolis. 75 and sunny (thermometer is in San Diego)

-by Mike

Lol, spot on

-