|

“One of the best courses that I have had in 17 years!” -Amy H

> OREP E&O |

Editor’s Note: Share your experience with trainees in Working RE’s Survey for Trainee Supervisors and help the entire industry. Take the four-minute survey now.

Desktop Appraisals—What are They and Will You Do Those Assignments?

by Dave Towne, Appraiser Education Service

Recently, from what I’ve been observing recently during my 21 years as an appraiser, there appears to be an increasing effort by many stakeholders. These stakeholders rely on appraisals to extricate appraisers from the actual property inspection and shift the appraiser’s responsibility to only being the analyst, comparable picker and report signer. This primarily is driven by the impression that speed from a borrower’s loan application to final acceptance is paramount. There has been frustration that appraisers have become a bottleneck in the process. Some people believe that turning the inspection part of the process over to someone else will help shorten the loan turn times, and maybe even save the borrower a few dollars in the process.

A recent initiative to facilitate this new protocol is the issuance of new forms by the two GSEs—named the “1004 (Desktop)” and the “1004 (Hybrid)”. These forms are in your report software package now. The other agencies have not yet adopted this reporting process for their loan underwriting.

These forms were distributed effective July 2020, without notice to most appraisers, at a time when everyone was caught up in COVID-19 issues. These forms were developed from the COVID-19 enhanced Scope of Work and Assumptions and Limiting Conditions for residential assignments, put in place in April 2020, which were allowed by the GSEs, FHA and VA.

In conjunction with those forms release, the GSEs were chatting with lenders and their Conservator about allowing non-appraiser-inspection reports to be used for first mortgage lending. They tracked the enhanced COVID-19 era reports, and decided that those were “just as good as” standard full inspection 1004 reports—even though they did not enforce the floor plan diagram as a required exhibit in reports.

This new policy to allow these new report types was formalized by the new FHFA director this past October 2021. But the issue I’m having understanding, is promoters are using a generic word desktop, and I’m not sure if both the 1004 (Desktop) and the 1004 (Hybrid) will be allowed for first mortgage lending.

While all this has been taking place, several AMCs and software developers have been creating and implementing smartphone apps and non-appraiser inspection processes and procedures. Several of these phone apps can have a floor plan generated which the appraiser can use in these new Desktop and Hybrid reports. These are now available to be used.

The current line of thinking is Desktop and Hybrid reports will take less time to turn around, from assignment date to submittal. The theory is they also could cost less than a traditional appraisal.

Are either of these suppositions true, or even the speed aspect? We won’t know until about the third quarter of 2022, after a number of these reports are delivered to the GSEs by appraisers who choose to do them.

The purpose of this article is to show appraisers, and other stakeholders, the differences between these Desktop and Hybrid reports, verses standard full 1004 URAR reports.

Once you review differences, we would appreciate you completing the short survey available on-line to inform the industry about your willingness to complete Desktop and Hybrid reports. If you choose to do them, indicate how your proposed fee will compare with a current 1004 URAR fee, based on a percentage difference.

(story continues below)

(story continues)

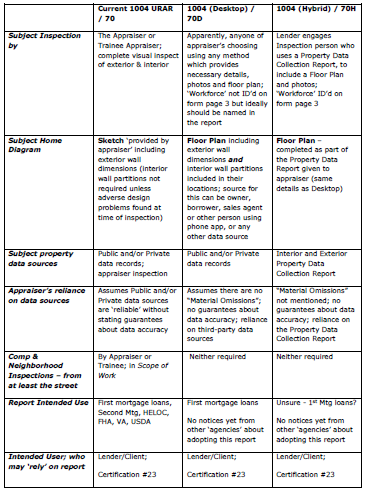

The table with this article (pictured below) shows primary differences with these three different report types. Those are significant. Appraiser workflow needs to be considered with these.

Report Comparisons – based on Forms Scope of Work, Assumptions and Limiting Conditions, and Certifications

Let’s step back and look at the big picture. Commentary I’ve seen in the past number of months appears to lean toward the Desktop report version. But when one looks at how the actual subject home inspection is to be done, it’s apparent that serious issues can arise. Some of the smart phone apps are designed to have the homeowner or sales agent hold the phone, and then be directed by the appraiser to take video and photos necessary—both inside and outside. Or else there will be a defined written process for the inspector to follow, and then submit the file to the appraiser.

Appraisals have been done by appraisers since the mid-1930’s. The public has an expectation that an appraiser will do the work necessary to examine the home and produce the report. But with the Desktop report option, the responsibility to do the interior and exterior inspection, photos and floor plan will be in the lap of the sales agent or homeowner, remotely directed by the appraiser. Does this really seem to be a viable option to speed up the appraisal process, or cost less? That’s questionable. FHFA director Thompson told mortgage bankers in October 2021 that the desktop appraisals will be more efficient for the appraiser. Do you agree?

The Desktop assumes there will be no opposition by the party who is asked to do the inspection. What happens if there is? Secondly, if the appraiser has to direct and teach the inspector holding the phone for whatever time necessary, is there an expectation that the appraiser will do that for free? Third, this option presumes nothing important with the property is missed, or that adverse items won’t be overlooked. These are the Material Omissions the table references. I see serious unintended consequences with this report option.

After putting these details on the table, I can see where the Hybrid option is less burdensome to the appraiser than the Desktop. Someone else who can be separately trained can do the on-site inspection, measuring and floor plan. Then the appraiser can receive that report and is entitled to rely on it under the extraordinary assumption that the provided report and details are reasonably accurate. With this Hybrid option, the appraiser can remain in their basement, working on reports, wrapped in their bathrobe and toe warming bunny slippers…as I do!

Now that you have a visual representation of the report types via the table, you will have to make a business decision about doing Desktop or Hybrid reports. For some appraisers, these are viable. For many other appraisers, especially those who believe we have a serious responsibility in the valuation and risk analysis process, may choose not to.

This article is in no way meant to disparage the various firms who have developed new technology to handle newer inspection protocols for these different reports. They’ve just been responding to other stakeholders in the valuation process. Technological advancements have been associated with appraisals for decades.

Please take the time to submit your responses to this short anonymous survey.

About the Author

Dave Towne, Certified Residential Real Estate Appraiser; owner of Appraiser Education Service.

Tips for Smoother Appraising

CE Online – 7 Hours (45 states)

How to Support and Prove Your Adjustments

Presented by: Richard Hagar, SRA

Must-know business practices for all appraisers working today. Ensure proper support for your adjustments. Making defensible adjustments is the first step in becoming a “Tier One” appraiser, who earns more, enjoys the best assignments and suffers fewer snags and callbacks. Up your game, avoid time-consuming callbacks and earn approved CE today!

Sign Up Now! $119 (7 Hrs)

OREP Members: Save 10%

>Opt-In to Working RE Newsletters

>Shop Appraiser Insurance

>Shop Real Estate Agent

Insurance

Send your story submission/idea to the Editor:

isaac@orep.org

by Novak Marcia

Brent Brown’s observations are correct on all counts.

-by Nancy kieffer

All of the rules concerning the appraisers liability would need to change. I can’t be expected to verify someone else’s work to be credible snd base value on it. It’s less expensive to just pay me

-by Brent Bowen

As an appraiser who has been experimenting with these forms and various other desktop and hybrid appraisals for several years, I see two issues:

-1) Decline in long term competency. It is difficult to remain geographically competent with desktop/hybrid work. Time in the field is necessary to remain competent regarding variances between different builders, neighborhoods, and trends. As someone who trains new appraisers, I have found that a balance between time in the field and time performing analysis is needed to produce good appraisers for the next generation.

2) There is always an inspection. As someone who has done appraisals utilizing a property condition report, I can tell you that there is time necessary to thoroughly review the report, photos, and sketch. It is a sort of mental inspection of the property, putting together all of the data, which isn’t ever organized the way that you would. Most of the time, I would have been able to inspect the property personally faster than the time necessary to review the property condition report. As was stated in this article, can you image the time necessary to virtually inspect with the homeowner?

So in my view, the primary efficiency gained is driving time, which the GSEs can eliminate significantly by removing the requirement to personally view each comparable. They already know this, but are moving forward anyway. It begs the question, ‘why’?