|

Published by OREP, E&O Insurance Experts | August 2012 |

Click to Read Current Issue |

|

Real Estate agents,

brokers and appraisers are being sued in record numbers today, even the

careful ones. You could be making a big mistake by giving up your

coverage for past work.

Editor’s Note:

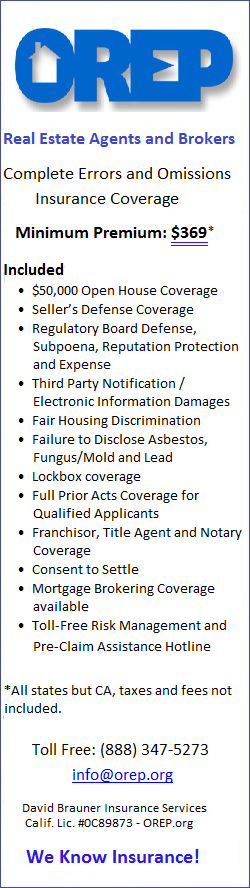

This interview with David Brauner, Senior Broker at OREP.org, offers good tips to all real estate professionals shopping insurance.Insurance: Insight and Advice from Inside

Interview with David Brauner, Senior Broker at OREP.org and Editor of Working RE Magazine

David Brauner, Senior Broker at David Brauner Insurance Services/OREP.org, has been providing E&O insurance to real estate professionals for 20 years. In this interview with a national appraisal publication, Brauner offers insight and advice from the inside on rates, claims, disciplinary actions, coverage and more.

Appraisal Buzz: Insurance professionals often say that not

all errors and omissions policies are created equally- that which company/policy

is important.

David Brauner:

There are a handful of agencies, including our own, who have been around awhile

and handle programs written specifically for appraisers/agents and brokers.

These programs have underwriters, counsel and other staff who are familiar with

the issues and have experience defending them. Some programs have “niche” extras

also, like “pre claims” advice and assistance and coverage for responding to

state board complaints for appraisers. So yes, it’s important to know what you

are buying and from whom. Most should offer you prior acts as well.

E&O insurance, of course, provides coverage for mistakes made in a professional

capacity; malpractice insurance.

Buzz: You always stress “prior acts.” Why is this coverage

so important?

Brauner: Most real estate professionals understand by now that their policies

are Claims Made, meaning that claims must be reported during the policy period.

The “policy period” ends when a policy is cancelled or allowed to expire.

Switching companies at renewal does not result in the loss of prior acts, as

long as the switch is completed before the policy expires and the new company

provides coverage for prior acts. Not every company does. If you switch to one

that does not, you are running the risk of not having coverage for an old report

when you need it. Most agents and brokers realize that claims take a year or two to

surface, which is why keeping prior acts coverage is so vital. For this reason,

many agents carry their own E&O, even if the broker they work for has a

company policy. This way, no matter what happens to the broker's

policy, the agent has control over their own individual coverage and can

keep it current. Individual premiums are priced low enough to make this a

smart strategy.

Buzz: So it’s important that real estate professionals

keep their coverage current?

Brauner: Yes it’s vital. Real estate

agents, brokers and appraisers are being sued in record

numbers today, even the careful ones. You could be making a big mistake by giving

up your coverage for past work.

Buzz: What about complaints against appraisers and others from

state boards?

Brauner: Unfortunately, we are seeing a large number of

complaints that are ill-conceived, emotional responses to the dramatic loss in

equity many homeowners are suffering. Sometimes, everyone is sucked in. No matter the merit, you

will have to

spend time and resources defending yourself-even if you have done nothing wrong.

It’s not fair but that’s the way it is. This is why losing your prior acts

coverage can really cost you should a problem arise from the past.

(story continues below)

(story continues)

Buzz: If you have a claim and it’s bad enough that an

insurance company drops you, how hard is it to get insurance elsewhere?

Brauner: Many times you can obtain coverage from another

carrier if you are dropped. We work with several alternate carriers. If you

have a claim, don’t give up. Sometimes all it takes is a fresh set of eyes,

especially if the issue is not too serious. We advise clients to prepare

their claim summaries and rebuttals for the best possible outcome:

concisely, professionally and with inclusion of new procedures that might

prevent the problem from happening again.

Conversely, and I say this with

all due respect, handwritten scrawl, ranting, incoherence, blaming others

for everything, even if it’s true, works less well in persuading an

underwriter that you are a good risk. It pays to put time and thought into

your response, even if the complaint is frivolous.

Buzz: What other advice do you have for those who find

themselves with claims or disciplinary actions?

Brauner: Report the event to your insurance agent/carrier when it

happens for your own protection. If you fail to report a claim and let your

insurance policy lapse, either intentionally or by forgetting to renew on

time, and then try to obtain a defense from the carrier, you may very well

be left without coverage, even if you were insured when you did the report.

That’s the way all Claims Made policies work. But if you get a claim or

dispute on the record during the policy period by reporting it to your

agent, it should be covered down the road even if you let your insurance

lapse and the policy is no longer in force. Also, most insurance policies

require you to report claims and incidences in a timely manner. Therefore, a

carrier can potentially refuse coverage if they feel the delay in reporting

hurt the defense. It hardly ever happens but you don’t want to be the

exception.

Buzz: So honesty is the best policy?

Brauner: For many reasons. You should report claims and

disciplinary actions on any and all insurance applications also. It may seem

counterintuitive to disclose something that is easier to hide and maddening

if the incident or complaint is frivolous and dismissed as such. But if it's

part of public record, disclosing is for your own

protection. And not just to make sure that there is coverage when you need

it. You also don’t want to report having “no claims or incidences” on an

application and then have a claim resurface that you clearly knew about prior

to submission of the application. Underwriters are the opposite of

insurance agents- underwriters look for any reason possible

not to write

your business. If they think you failed to disclose something intentionally,

they may refuse coverage for what they consider to be dishonesty. If this

happens, it makes it harder to get coverage elsewhere, as you might expect.

Buzz: So claims and incidences should be reported by

appraisers/agents and brokers for their own good?

Brauner: Yes for the reasons stated. Also, receiving

professional assistance early can often diffuse an issue and make it go

away.

Buzz: Any other advice for those with claims/incidences?

Brauner: Yes, we advise clients to submit their renewal

information, including claims documents, far in advance of expiration to

allow adequate time for quoting. Renewals with claims are more complicated

and take longer to underwrite. Beginning the process early can relieve the

stress of uncertainty as your policy expiration date approaches. And it

gives you time to shop.

Buzz: What other insurance advice do you have?

Brauner: The best advice I can offer about insurance is to make sure

you have it when you need it. If you have insurance, renew before the policy

expires to ensure continuous coverage for all past work. That is more

important today than ever. We contact our insureds through mailings, e-mail

and phone calls, as their expiration date approaches, to make sure they know

what’s at stake. If you’re retiring, consider Extended Reporting Period or

“tail” coverage so you can sleep at night. This covers your old reports into

the future. It can only be purchased from your current carrier and only for

a limited time after the policy expires.

Buzz: And if you don’t have insurance?

Brauner: If you don’t have insurance, consider getting

it because even good real estate agents and brokers get sued. Consider this: as

expensive as E&O seems these days, the most recent “average cost of

defending a claim” that I have seen is $25,000. If you have to defend

yourself out of pocket, that is many decades’ worth of premium.

Agents may also want to consider general liability

insurance. Business Owner's/General Liability Policy has been compared to a

homeowner’s policy for your business. Coverage includes but is not limited to

property damage to others, bodily injury, business interruption and loss of

income coverage, personal property coverage (computers, client records,

buildings) and employee dishonesty. Real estate agents/brokers should consider

this coverage. Minimum premiums are around $500.

Buzz: Any closing thoughts?

Brauner: I’d like to thank everyone who has entrusted

their insurance to us over the years. Our mission at OREP is Business by the

Golden Rule, which means treating everyone the way we want to be treated;

with honesty, efficiency and courtesy.

ATTENTION: You are receiving WRE Online News because you opted in at WorkingRE.com or purchased E&O insurance from OREP. WRE Online News Edition provides news-oriented content twice a month. The content for WRE Special Offer Editions is provided by paid sponsors. If you no longer wish to receive these emails from Working RE, please use the link found at the bottom of this newsletter to be removed from our mailing list.