|

“One of the best courses that I have had in 17 years!” -Amy H

>> OREP E&O |

Editor’s Note: This article is reprinted from Freddie Mac’s Single-Family division.

The Effect of COVID-19 on Appraisal

by Danny Wiley, Senior Director of Valuation for Single-Family Credit Risk Management at Freddie Mac

There’s been widespread speculation about the specific effects of the COVID-19 pandemic on appraisal volume. Has it been greatly affected? Are the temporary appraisal flexibilities being used? What about waivers and their impact? But the good news is that there’s no need to speculate about these questions because there’s available data to answer them. And I’d like to share the insights we’ve gotten here at Freddie Mac by analyzing that data.

Over the years, Freddie Mac has routinely tracked the monthly volume of appraisal reports submitted through the Uniform Collateral Data Portal® (UCDP®). Because appraisal reports are a primary collateral risk management tool for Freddie Mac, the number of reports and the number of appraisers submitting those reports are vital to our collateral risk analysis

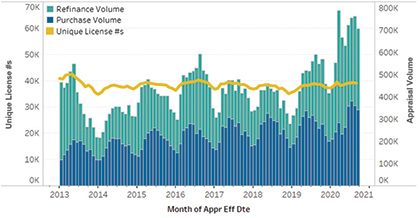

During that time, we’ve shared this data when we’ve presented at industry conferences and events related to appraisals or risk management. The graph below (Figure 1) is a great example of information we’ve presented recently. It shows the number of appraisal reports completed using Single-Family and condominium appraisal forms (form 70 and 465) submitted through UCDP each month since January 2012 (when we started collecting appraisals in UCDP). While UCDP submissions alone don’t account for all appraisal volume, this data offers reliable indicators for overall appraisal volume levels.

What Does the Data Say?

As you can see (Figure 1), despite the many impacts of COVID-19, appraisal volume to UCDP during the early months of the pandemic (March–September 2020) represents the seven highest volume months to UCDP on record. A closer look shows that distinct appraisals submitted to UCDP have increased 53% between 2014 and 2019 (about 9% per year). Moreover, when looking at appraisal report submissions from January to September of this year, the numbers show a 40% increase in appraisal volume over the same time period in 2019.

Appraisal volume to UCDP during the early months of the pandemic (March-July 2020) represents the five highest volume months to UCDP on record.

The data also clearly show the seasonality in volume, year over year. Volume tends to peak in the spring and summer and decline during the winter months. That trend has continued in 2020 despite the pandemic.

Another key point to note is the relatively fixed nature of the number of active appraisers (as measured by unique appraiser credentials) submitting appraisals to UCDP. While monthly appraisal volume has varied from about 200,000 to 800,000 between 2014 and 2020, the number of active appraisers has remained relatively flat—hovering just shy of 40,000 per month. This relatively fixed number of appraisers supporting significant fluctuations in demand can create stress in some markets.

What Are Lenders Saying?

Over the last six months, we’ve gotten reports from our clients that they’re seeing longer appraisal turn times and higher fees. This isn’t surprising considering the data above related to increased volume and the fairly static number of active appraisers. And clients have voiced concern that it will only get worse if we rely solely on the existing appraiser resource pool without making prudent alternatives available.

What Role Have the COVID-19 Temporary Flexibilities Played?

An example of these alternatives is the COVID-19 temporary appraisal flexibilities we’ve instituted that allow for desktop and exterior-only appraisals. The adoption and use of these flexibilities vary greatly from area to area. In locations with a higher concentration of COVID-19 cases, use of the flexibilities tends to be significantly higher—which isn’t surprising considering that they can help ease concerns around social distancing. However, in every state, the majority of appraisals during the pandemic have been completed based on the traditional interior and exterior inspection appraisals.

What Role Have Appraisal Waivers Played?

In some cases, Freddie Mac uses automated collateral evaluation (ACE) to assess collateral risk rather than an appraisal report prepared by an appraiser. The use of ACE in the appropriate situations, as a sound collateral risk management tool, has contributed significantly to keeping the mortgage market moving and keeping borrowers and appraisers safe during the pandemic.

The volume of appraisal submissions to UCDP over the last several months clearly shows the increased usage and continued demand for appraisals. However, the number of appraisers completing and submitting appraisal reports has remained relatively stable. This means more volume per appraiser, which generally affects appraisal turn times. The use of ACE in certain cases helps relieve some of that pressure.

The use of ACE in the appropriate situations has contributed significantly to keeping the mortgage market moving and keeping borrowers and appraisers safe during the pandemic.

Conclusion

During the last few months, we’ve seen record high appraisal submissions to UCDP, along with the use of appraisal waivers and COVID-19 temporary flexibilities. Despite the reasons for the current record volume, it’s our job to be prepared. We’re committed to fulfilling our mission of providing liquidity, stability and affordability to the U.S. housing market—regardless of economic conditions—to communities from coast to coast.

Looking back just six months to the onset of the pandemic, there was so much uncertainty. We worked extremely hard, in collaboration with Fannie Mae and at the direction of our regulator (FHFA), to quickly stand up processes that would promote safety for all parties involved in the mortgage process, while also allowing the market to continue moving. Offering contactless and responsibly distanced options, that also allowed us to effectively manage our risk, was both timely and prudent. Ultimately, those actions helped maintain good, and safe, collateral risk evaluation in a time of heightened demand for appraisals.

About the Author

Danny Wiley is Freddie Mac’s Senior Director of Valuation for Single-Family Credit Risk Management. He is responsible for Freddie Mac’s collateral risk management and its valuation team. He is also responsible for innovation in collateral risk analysis.

Sign Up Now! $119 (7 Hrs)

OREP Insured’s Price: $99

>Opt-In to Working RE Newsletters

>Shop Appraiser Insurance

>Shop Real Estate Agent

Insurance

Send your story submission/idea to the Editor:

isaac@orep.org

by JAMES SCHOLL

Unfortunately, he did not mention the stunning increase of appraisal waivers;

An explosion of appraisal waivers. Is that good or bad?

April 6, 2021 By Ryan Lundquist 47 Comments

Appraisal waivers have really exploded in recent years – especially during the pandemic. But how many are there exactly? Let’s look at actual numbers to walk away with some perspective. These stats are from January 2021 from AEI.

QUICK SUMMARY:

47.4% of all Freddie Mac loans had a waiver

44.5% of all Fannie Mae loans had a waiver

Waivers are far more common during refinances

Only 10-12% of purchases had an appraisal waiver in January

Non cash-out refinances have the most waivers (67-69%)

The higher your loan-to-value, the lower your chance of a waiver

Waivers have seen a dramatic increase during the pandemic

NOTE: This post is not about buyers removing the appraisal contingency. That is in a sense a “waiver”, but the topic here is Fannie Mae and Freddie Mac not requiring an appraisal.

http://sacramentoappraisalblog.com/2021/04/06/an-explosion-of-appraisal-waivers-good-or-bad/

-by William

I wouldn’t know how the ACE program kept me safe, I was told by virtually all of my clients there would be no accommodation made for Covid. I was in roughly 120 homes, mostly occupied from about March through December 2020. I had two choices, do the work or not. The Lender staff were all at home remote working…I’ve somehow avoided issues, I hit all the due dates, declined very few, and happen to think this is mostly just talking up ACE and valuations made from alternatives. I’m really not complaining, although few appraisers were kept safe, just guessing. Sorry, not on the bandwagon seeing that ACE is the mortgage savior of the pandemic. My partner nearly died from Covid, is going to be a long hauler for a few months looks like. But hey, thank goodness for ACE.

-